Therefore, sales returns and allowances is considered a contra‐revenue account, which normally has a debit balance. Recording sales returns and allowances in a separate contra‐revenue account allows management to monitor returns and allowances as a percentage of overall sales. High return levels may indicate the presence of serious but correctable problems. The first step in identifying such problems is to carefully monitor sales returns and allowances in a separate, contra‐revenue account.

What is the accounting treatment of Sales Returns and Allowances?

- Credits decrease asset and expense accounts, and increase revenue, liability and shareholders’ equity accounts.

- Sales or revenues is a credit account due to its nature of being an income or increase in equity.

- We will need to keep the returned goods in the company’s warehouse and reflect this transaction correctly in the accounting records.

Instead, companies allow a specific deduction from the original price agreed with customers. However, it still affects a company’s revenues in its financial statements. Sales returns and allowances are important figures in accounting, reflecting the reduction in a company’s revenue due to returned products and customer discounts. Sales allowances, on the other hand, are discounts given to customers for keeping such defective or unwanted products instead of returning them. This sales return allowance account is the contra account to the sales revenue account. A sales revenue journal entry records the income earned from selling goods or services, debiting either Cash or Accounts Receivable and crediting the Sales Revenue account.

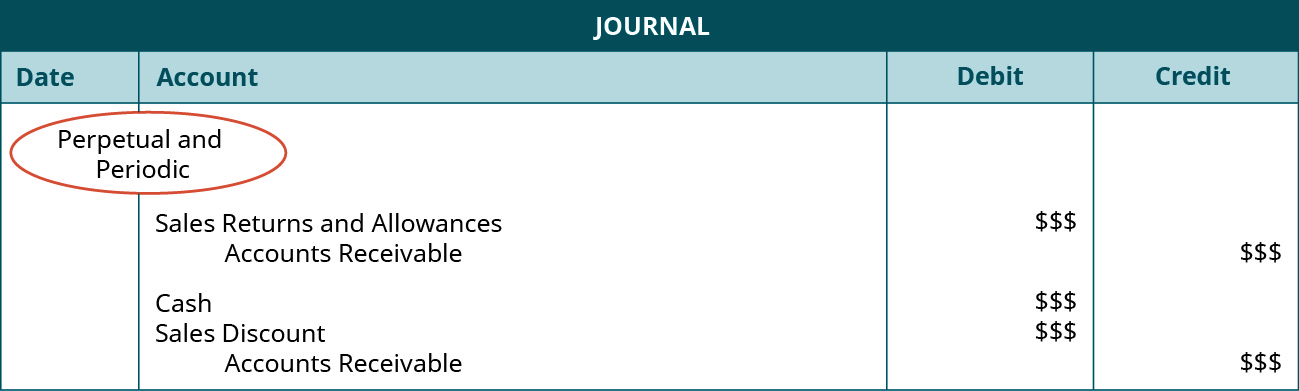

Return of Merchandise Sold on Account

So, only sales return account and its related credit size are recorded in the journal entry. In the seller’s books, a return or allowance is recorded as a reduction in sales allocating llc recourse debts revenue. Since the sales account normally has a credit balance, returns and allowances could be recorded on the debit side (the reduction side) of the sales account.

Accounts Receivable Turnover Ratio Analysis: Overview, Formula, And Analysis

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

The other account that will be affected the same amount as finished goods is the cost of goods sold. The ABC cosmetics purchase product Y at $40 per piece and product Z at $20. In other words, the account payable in the buyers’ book is reduced.

Sales returns and allowances are not expenses, but they are recorded as deductions from a company’s gross sales. This account has a negative or debit balance, so it is also called a contra-revenue account. In this case, the company provides an allowance to customers as compensation and the customers do not need to return goods. Hence, there is no impact on inventory and cost of goods sold transaction.

These returns and allowances, in turn, reduce either credit sales, accounts receivable, or cash in the company’s balance sheet. Afterward, another journal entry may be required in which the accounts payable account is debited and the cash account is credited. This journal entry is made when a cash refund is given to the customer for the goods they returned.

AccountDebitCreditSales Returns and AllowancesXAccounts ReceivableXThe entries show that as your returns increase, your assets decrease. You need to record a sales return journal entry in your accounting books. To account for a return, reverse the revenue and cost of the good recorded in the original sale. In accounting parlance, nominal accounts are transactions that report revenues, expenses, gains and losses.

However, others will separate them into two accounts for better presentation and processing. There are two approaches for making journal entries of transactions related to sales returns and allowances. A company may choose any approach depending on its volume of returns and allowances transactions during the year.

Sales returns are an important part of the sales process because it allows a company to continuously provide high-quality goods and services to their customers. So you give them a discount of 20% to make up for the inconvenience, making the final sale price $40. Here are a few different types of journal entries you may make for a sale or a return depending on how your customer paid. Debits and credits work differently based on what type of account they are.