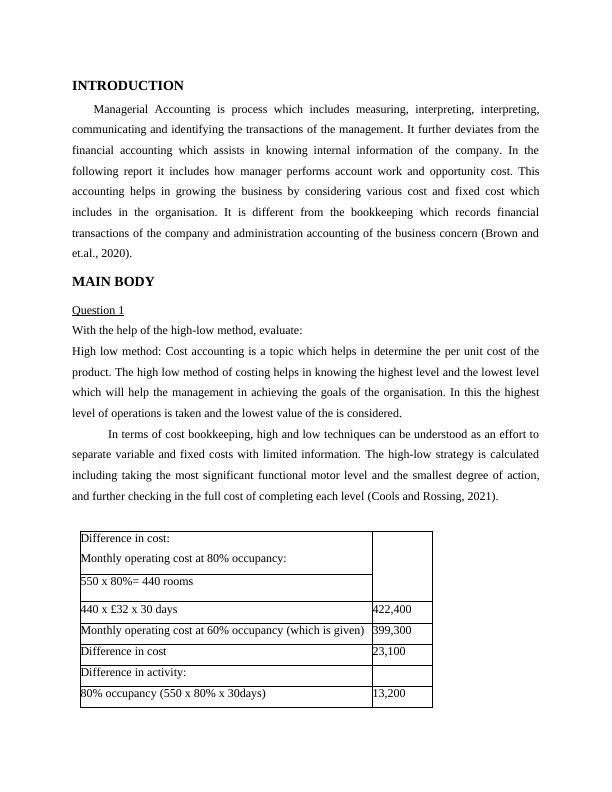

By using this method, we observe only the highest and lowest points in the data set with the assumption that all the data have a linear relationship. We use the high-low method accounting formula to calculate the variable unit per cost as the change in total cost divided by the change in units produced (or other measure of activity). Under this conceptualization of meta-analysis as a multilevel model and the potential extension via addition of higher levels of clustering, many of the existing features of meta-analysis take on a new interpretation. Here, studies are regarded as clusters sampled from the underlying patient population which themselves are clustered within the nations that they are drawn from.

Variable Cost per Unit

The high-low method is generally not preferred, as it can yield an incorrect understanding of the data if there are changes in variable- or fixed-cost rates over time or if a tiered pricing system is employed. In most real-world cases, it should be possible to obtain more information so the variable and fixed costs can be determined directly. Thus, the high-low method should only be used when it is not possible to obtain actual billing data.

Step 3: Compute Fixed Cost Using the Variable Cost per Unit in Step 2 and the Cost Equation

- The following are the given data for the calculation of the high-low method.

- You need to know what the expected amount of overheads that your production line will incur in the next month.

- Published studies reporting the number of perioperative deaths from bellwether surgical procedures among adults will be identified from MEDLINE, Embase, Cochrane CENTRAL, LILACS and Global Index Medicus.

- It uses this comparison to estimate the fixed cost, variable cost, and a cost function for finding the total cost of different production units.

- The activity level can pertain to any measurable business activity, such as documents processed, units produced, finished goods inspected, or services rendered.

In other words, the variable cost rate was $0.10 per machine hour ($2,000/20,000 MHs). The variable cost per unit is equal to the slope of the cost volume line (i.e. change in total cost ÷ change in number of units produced). High low method uses the lowest production quantity and the highest production quantity and comparing the total cost at each production level.

How to use the high-low method? – High-low method formula

The Total cost refers to a summation of the fixed and variable costs of production. Suppose the variable cost per unit is fixed, and fixed costs at the highest and lowest production levels remain the same. In that case, the high-low method calculator applies the high-low method formula to evaluate the total costs at any given amount of production. You can then use these estimates in preparing your budgets or analyzing an expected monetary value for a contingency reserve. The high-low method in accounting is the simplest and easiest way to separate mixed costs into their fixed and variable components.

Step 2: Compute Variable Cost per Unit

An example of a mixed cost is a production line, where fixed costs include the wages of the employees required to man all work stations along the line, and variable costs include the materials used to construct the products passing through the production line. If the variable cost is a fixed charge per unit and fixed costs remain the same, it is possible to determine the fixed and variable costs by solving the system of equations. It is worth being cautious when using the high-low method, however, as it can yield more or less accurate results depending on the distribution of values between the highest and lowest dollar amounts or quantities. Additionally, extending the model to include covariates is straightforward in the GLMM space. This is another advantage for this study to help reduce confounding and account for unexplained variation between studies [30].

To Ensure One Vote Per Person, Please Include the Following Info

Since POMR is a rare event, and the risk is not evenly distributed among surgeries, there is a high likelihood that several studies will include no perioperative mortalities. Included studies will have their data extracted and compiled to create a database on POMR and cause-specific POMR. This data extraction will be conducted using a standardized data extraction form that will be created in the REDCap data collection software and piloted using the development mode before use for actual extraction. The data collection instrument will be created as a repeat instrument in the software allowing for each reviewer to extract the data independently and then a final harmonized version to be exported for data analysis. Studies excluded from the review will still be maintained in a separate file for record keeping and transparency purposes. The title and abstract screening stage will be conducted by a single author, and the full text review will be conducted by two independent reviewers, with conflicts being resolved by consensus.

From the included studies a multilevel meta-regression will be constructed to synthesize the results. This model will conceptualize patients as nested in studies which are in turn nested within countries while taking into account potential confounding variables at all levels. In cost accounting, the high-low method is a way of attempting to separate out fixed and variable costs given a limited amount of data.

Yes, because it is a simple tool to compute costs at different activity levels. It can also be used for budgeting purposes, especially for business activities with fixed and variable components. Therefore, total fixed costs for client support calls is $1,500 per month. In the side-by-side computation moving expenses above, we’ve proven our point that regardless of which reference point we use, we still arrive at $1,500. The high or low points used for the calculation may not represent the costs normally incurred at those volume levels due to outlier costs that are higher or lower than would normally be incurred.

Using either the high or low activity cost should yield approximately the same fixed cost value. Note that our fixed cost differs by $6.35 depending on whether we use the high or low activity cost. It is a nominal difference, and choosing either fixed cost for our cost model will suffice. By investigating the published literature and providing a synthesized estimate of surgical mortality, as well as the existing trends regarding its incidence this project could help create an estimate of where we need to be focusing to help make surgery safer. Additionally, the data resulting from the eventual meta-analysis may be useful as a benchmark from which future system-level quality initiatives could use as a baseline in assessing future surgical performance. The findings from this project may help policymakers and other stakeholders assess the quality of surgical systems in their jurisdictions as well as plan for future surgical system needs.