loans Naples

Because the its inception into the 1998, he’s offered borrowers having high quality mortgage attributes and you will preserve their character as among the greatest labels in the market. Its lending pool is stuffed with certain loan providers, tribal otherwise condition lenders.

Keeps

- Quick and easy App Processes: Particular networks in the business create ask for an initiation percentage prior to they create consumers to acquire money off their system. So it brand fees n0 charge on how best to initiate financing techniques.

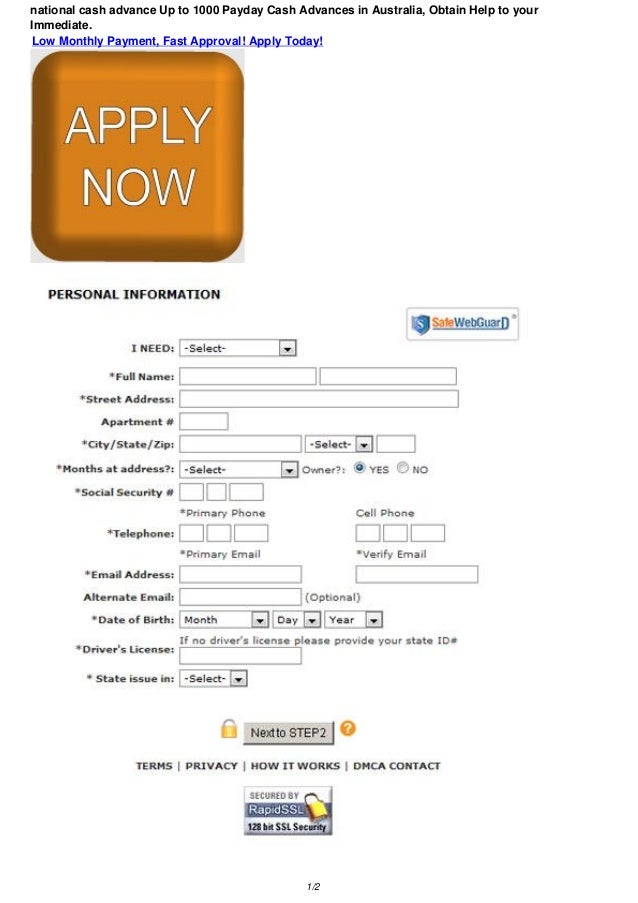

After you log on the webpages, you might be available with an application form that you have to fill in which have perfect details and fill in the form once you are performed. This form is relatively easy to see, plus the estimated time for you end up was five minutes.

Individuals with bad credit ratings need not love not receiving that loan render regarding that program as they are its number one notice. It works near to 3rd-people loan providers to be certain individuals score mortgage offers regarding system.

Therefore, in the event the a borrower cannot get any loan render about lenders on the program, the working platform often supply loan providers out-of external.

- Flexible Payment Terms: That it platform is amongst the most useful professionals to get the brand new loan amount you would like regardless of your credit score. They don’t really value the risk involved; they merely consider working for you.

The utmost amount borrowed expected is $10,100, plus the fees small print are very right for brand new debtor to spend quickly. You should understand that bringing a comparable fees plan from several other platform is virtually impossible.

It platform’s mortgage payment time vary regarding 90 days to 72 days. And also the lenders on this program are pretty considerate; their attention costs start from 5.99 per cent to %.

- Security: As we told you in the round assessment, he is dedicated to ensuring that their borrowers’ info aren’t confronted by the hacking business. New encoding program they normally use to help you safe the website is but one of the best in the market, and it also will set you back a lot.

Regardless, they only need certainly to make sure borrowers can seem to be safer playing with its system plus don’t have any need so you can doubt their connection. As a result, the working platform try dependable and you may safe.

- Academic Info: As with all the programs you will find required, this type of platforms plus article articles on their site to teach the consumers towards the some aspects of loaning money. On top of that, he or she is committed to training its borrowers on action-by-action process inside it and how to accept compatible loan offers.

Experts

- Merely work on legit loan providers

- You could get in touch with the support service twenty-four/7

- There clearly was an amount borrowed limit off $ten,000

- you’re not expected to shell out any initiation percentage for making use of the platform

- Users can easily comprehend the has on the website

Cons

- The private information that is requested is a lot compared to many other networks

Whenever calculating a few of the most popular programs in the nation, RadCred will most likely fall-in their better three. It system now offers mortgage properties to people with bad credit score, making certain the lenders dont consider the credit rating.

Although a lot of the individuals has bad credit scores, so it platform however even offers a large amount of cash to them just like the mortgage number. And you can borrowers can buy financing out-of that system long lasting reasoning.

One of the recommended provides making sure borrower satisfaction ‘s the algorithm connecting consumers and you may lenders. When borrowers complete the application form, they are requested to fill out the type of mortgage small print needed. Next, the new algorithm tend to identify lenders prepared to give you the exact same conditions and terms.