Important for possible residents, the home mortgage EMI calculator estimates monthly mortgage payments, enabling them to evaluate cost correctly and package their property buy intelligently, ensuring they could comfortably do the financing costs close to almost every other expenditures.

Car loan EMI calculator:

Geared to car and truck loans, this simple EMI calculator exercise month-to-month repayments, assisting some one in the cost management because of their vehicles pick. The vehicle loan EMI calculator assists anyone in choosing financing alternative one to aligns and their financial possibilities and you can choices, thereby assisting a delicate and you will advised automobile to shop for processes.

Two-wheeler financing EMI calculator:

A two-wheeler loan EMI calculator helps you imagine your monthly payments by the inputting the borrowed funds number, interest rate, and you will period. It includes a definite economic bundle, making sure you really can afford the 2-wheeler towards loan in advance of committing.

Company loan EMI calculator:

Vital to have business owners and you may enterprises, the business mortgage EMI calculator exercises monthly premiums for different business fund, enabling energetic financial considered and you may government, making sure enterprises is also sustainably perform their funds flow and spend some information effectively to support its gains and you can expansion efforts.

Doc mortgage EMI calculator:

Specifically made to support doctors, your doctor financing EMI calculator creates payment times getting financing tailored to their unique economic conditions, assisting from inside the energetic financial management, enabling doctors to a target their practice without worrying towards intricacies away from loan payments, thus promoting economic balances and you can peace of mind.

Financing against securities EMI calculator:

Available for consumers looking to money backed by economic property, so it EMI calculator on the web helps determine EMI repayments, providing understanding on the fees schedules and you will financial responsibilities. Giving appropriate payment rates, it allows individuals so you can bundle the funds effortlessly, ensuring they are able to manage the mortgage debt instead of undue be concerned or uncertainty, hence assisting a clear and told credit feel.

Loan against possessions EMI calculator:

Financing Facing Property (LAP) EMI calculator is a financial equipment accustomed imagine the latest Equated Month-to-month Instalment (EMI) payable with the that loan safeguarded up against assets. It takes into account parameters including the loan amount, interest, and you can financing period so you’re able to calculate the latest month-to-month fees matter. From the inputting these records, consumers can very quickly dictate the potential EMI loans. It calculator facilitate individuals bundle its profit effectively giving clear expertise on value and you can payment schedule.

Drifting rate EMI calculation

A floating speed EMI (equated monthly cost) formula is founded on an adjustable interest that will change along the mortgage tenure. Rather than repaired-price funds, where in fact the rate of interest stays lingering, floating costs vary considering industry conditions, generally speaking linked to a benchmark such as the Set-aside Financial regarding India’s repo rates. Thus your own EMI increases otherwise fall off over time, with respect to the rate of interest way.

- Natural drifting rates: The pace completely reflects business transform, changing sporadically based on the lender’s benchmark rates.

- Crossbreed speed: Integrates repaired and you can floating pricing, will beginning with a fixed rates having a primary months ahead of switching to a floating price.

- Partly floating speed: The main amount borrowed are subject to floating interest, while the people was at a fixed price.

- Instant results: An EMI calculator fast works out equated month-to-month instalments (EMIs), giving immediate insights on the installment wide variety, enabling individuals so you’re able to easily measure the cost of their fund and you will make told economic choices without delay. That it saves some time will bring understanding inside controlling profit effortlessly, increasing total financial literacy.

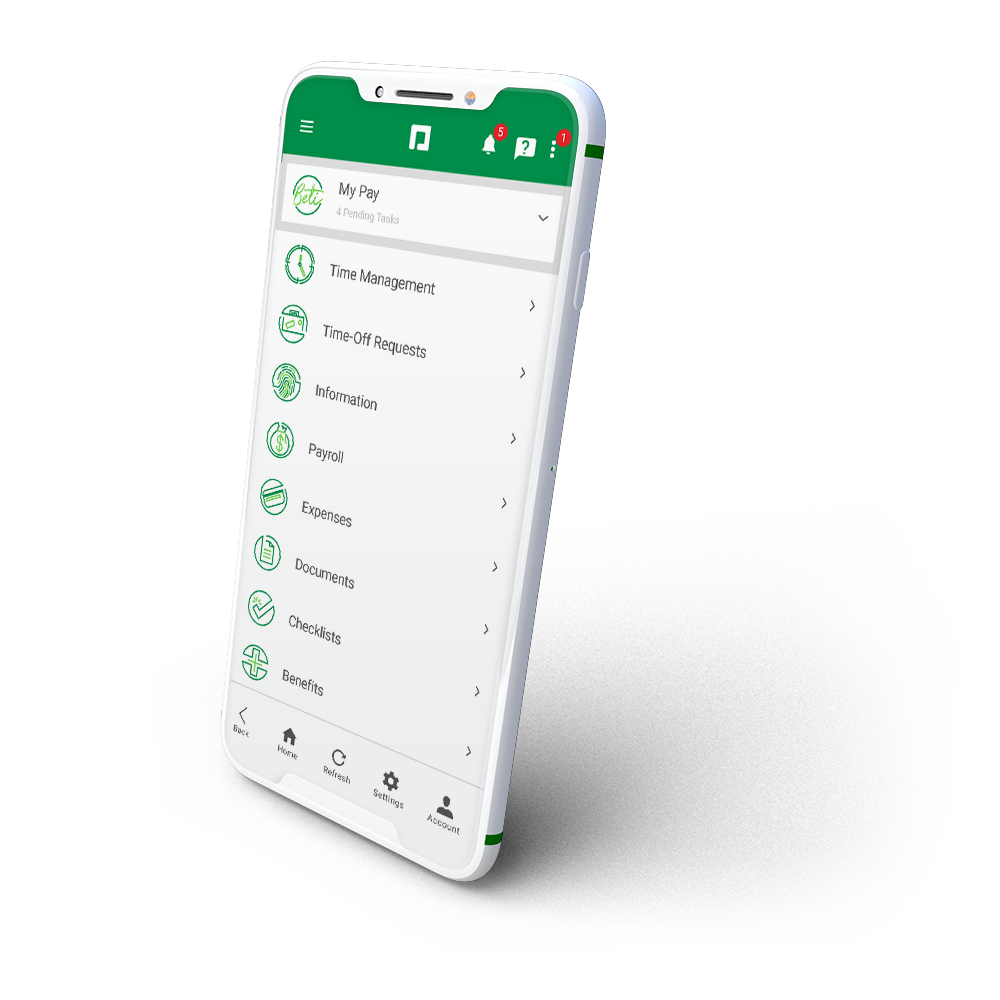

- Much easier availability: Obtainable 24/seven out-of people place which have websites relationships, these calculators encourage pages to plan their cash in the its convenience, removing the necessity for visits in order to creditors and you will enabling effective monetary administration with the-the-go. That it flexibility caters busy https://paydayloancolorado.net/weldona/ dates and you will promotes proactive monetary believe and you will decision-and come up with.