Consumer Conformity Outlook: Third Quarter 2013

On wake of the financial crisis, household property beliefs refuted rather in lots of areas. In response, of several loan providers suspended home guarantee lines of credit (HELOCs) or less borrowing limitations, doing conformity and you will fair financing threats. While you are homes pricing has actually rebounded throughout the downs of drama, creditors need certainly to be attentive to the loans under Control Z when a serious decrease in a beneficial property’s value that anticipate a beneficial creditor when planning on taking this type of actions might have been recovered. Loan providers must know the new fair credit chance from the these steps. This short article brings an introduction to the conformity requirements and you can risks when a collector requires step into good HELOC because of a improvement in property value. step one

Control Z Compliance Standards

Section of Controls Z imposes extreme conformity conditions on HELOC loan providers. So it point not merely means revelation off plan fine print as well as fundamentally prohibits a creditor from changing all of them, except in specified factors. You to definitely circumstance permitting a creditor so you can suspend a great HELOC otherwise cure the borrowing limit occurs when the property protecting the newest HELOC enjoy a critical decline in worth, due to the fact provided from inside the several C.F.R. (f)(3)(vi)(A):

No collector could possibly get, by bargain otherwise … changes any term, besides a collector get… ban more extensions away from borrowing otherwise reduce the credit limit applicable to help you a contract through the people months where in fact the worth of the dwelling you to definitely secures the program declines rather underneath the dwelling’s appraised worth getting reason for the master plan. dos (Emphasis extra.)

The brand new controls cannot explain good high refuse. Yet not, Feedback (f)(3)(vi)-6 of the Certified Professionals Responses (Commentary) will bring loan providers with a secure harbor: Should your difference between the original credit limit as well as the available collateral is actually quicker in half due to a worth of refuse, the latest refuse can be considered significant, providing financial institutions so you can reject extra borrowing extensions or slow down the borrowing from the bank restrict getting good HELOC plan.

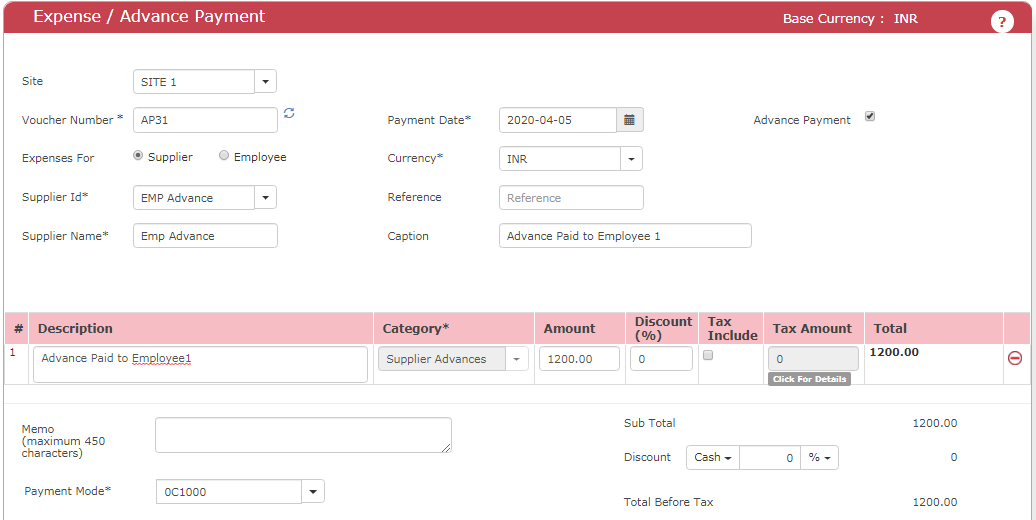

Whenever choosing if or not a life threatening decline in value possess taken place, financial institutions will be contrast the fresh dwelling’s appraised well worth during the origination resistant to the latest appraised worthy of. Brand new desk lower than will bring a good example. step three

Within analogy, new collector you can expect to exclude subsequent advances or reduce the borrowing limit if the property value the house refuses of $100,000 so you’re able to $ninety,000. Government will likely be aware one to although they tends to be permitted to slow down the credit limit, the brand new protection can’t be below the number of the fresh new an excellent equilibrium in the event that doing so would want the user and come up with a high payment. cuatro

Property value Steps

The fresh creditor is not needed to obtain an appraisal ahead of reducing otherwise freezing a HELOC if the domestic well worth has actually fell. 5 not, to have test and recordkeeping motives, the collector will be keep up with the records upon which it relied so you’re able to expose you to definitely a serious decrease in property value occurred before taking installment loan Rhode Island action towards HELOC.

Inside , the latest Interagency Credit Risk Administration Recommendations to possess Household Security Financing is typed, which has a discussion away from collateral valuation administration. six This new advice will bring samples of chance administration practices to consider while using automated valuation models (AVMs) otherwise taxation comparison valuations (TAVs). Subsequent guidance on appropriate techniques for making use of AVMs otherwise TAVs are considering about Interagency Appraisal and Investigations Advice. eight Government may want to take into account the guidance when using AVMs otherwise TAVs to determine whether a significant refuse provides took place.

Together with regulating conformity, organizations should be aware of one to plenty of category action suits was indeed filed challenging the employment of AVMs to attenuate borrowing from the bank restrictions otherwise suspend HELOCs. 8 The brand new plaintiffs in such cases have challenged various regions of compliance, such as the use of geographical location, in lieu of personal property valuation, while the a basis to have a good lender’s searching for of reduction in value; this new AVM’s precision; and also the reasonableness of the is attractive processes positioned where a debtor may issue the fresh reduction of the fresh new credit line. Into the white in the litigation risk, it is essential for institutions to spend careful attention to help you conformity requirements.