When it comes to the standards one influence the fresh new acceptance of a property equity financing, and for one mortgage in fact, best question that standard bank tend to consider was your own creditworthiness loans in Whitesboro, i.e., can you pay the mortgage.

- Income and you can workplace

- Home loan obligation

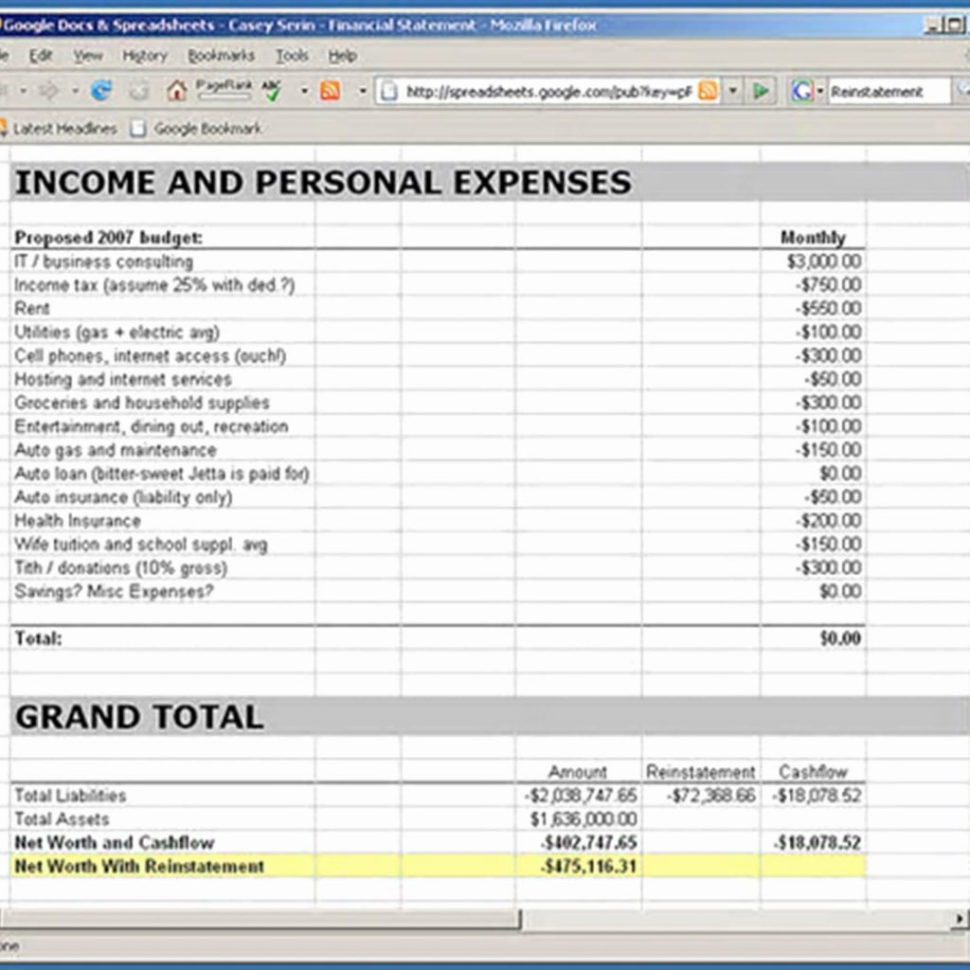

- Property what you possess

- Liabilities what you owe

- Credit history

Consider each one of these products. There’s you might fully grasp this pointers readily available; it simply might not be as planned otherwise as easy to help you arrived at since you would like, but you can do this. In addition to note that your lender might need most other records. Get ready.

Your earnings and you can employment are major situations which can determine their power to rating a house security approval. You really need to reveal just how long you’ve been functioning as well as how far currency your give into your domestic.

Whenever you are mind-operating, expect you’ll bring various other suggestions. More often than not, loan providers like to see your very own and organization tax returns and often the last 2 years. They’ll would also like to see a revenue and you can losings report.

Whether or not thinking-functioning or otherwise not, you could is youngster assistance or alimony costs due to the fact more earnings in the event it relates to your.

Your existing financial might bring important recommendations and you may once more a major determine of your own capacity to get approved getting property equity financing. In addition to, dependent on where you get first-mortgage and how old their mortgage is actually is dependent upon everything requisite. You might apply for a house equity on another economic place than just in which you get first mortgage since these was one or two independent mortgages an initial and you can a secondary.

This short article naturally tells the bank if you possibly could repay your residence equity loan over time

It is a lot of fun to adopt any possessions. Collecting your own financial comments is the first activity for accumulating investment pointers. Then you will desire details of the many almost every other assets such as for instance as your retirement membership, brings and ties and every other home you might keep. You can find how this begins to tie into your capacity to show your lender you can pay your loan over the years.

Oftentimes, your debts will include all other loans you have got, credit card debt and just about every other money you create on the a good monthly foundation

Now that you’ve revealed your financial that which you has, you’ll also must show your bank your obligations your debts. Ergo, if you shell out youngster service otherwise alimony, you will need to make sure to inform you this type of payments as an accountability.

In the long run, your credit history will state your lender probably the most about yourself are you experiencing a credibility to have investing your own costs. Based on your credit report have a tendency to your own bank dictate that you can pay right back the borrowed funds? In most cases, there’s factors towards a credit report possibly regarding school weeks or misunderstood scientific expenses. It certainly is a smart idea to feedback your credit history thus you could potentially clarify any problem that is bringing your credit score down.

An advantageous asset of providing all your valuable financials to one another is the fact it really does leave you the opportunity to organize debt lifestyle. It’s always a benefit to have this part of your lifetime in a few version of acquisition in case you need to access such files with other factors which could exist. Would be a good for you personally to set up some data files. Simply saying…

All this appears like plenty of recommendations. And you may not want this records. Although not, keep in mind you want to provide your own financial a very clear look at debt lives. This type of facts will unquestionably determine the recognition out of property equity financing. So long as you provide this informative article on your financials, might bring the bank ideal question he’s in search of when obtaining property equity loan your capability to expend straight back the borrowed funds.

For additional info on a good HELOC excite telephone call Chelsea State Lender at the otherwise visit us within to begin with. We are here in order to.