Property possess always held worthy of in america, while you have got a clear deed so you can real estate property, you might be able to utilize it collateral having a financing.

There was many papers in property ownership. Pick would be to make sure that your records is in purchase and the assets deed is actually the term. You will discover from the County Recorder’s place of work about condition in which the home is located. Home deeds try a point of personal number, thus anybody who desires this post can obtain they.

A documented action will bring observe to next purchasers, lenders, and the community on the a plot of land out of houses. Additionally, it handles the master of listing though multiple functions claim possession of the same house.

When a property transfers in one owner to a different, you need to enhance the state files. Faltering so you can precisely listing the desired data files is void brand new import.

After you have confirmed that name’s towards deed, the next step is to get a lender that will loan facing a land action. House fund should be hard to find. Particular loan providers dont take on land since security after all, while others only imagine home that is really worth a certain amount. Very lenders will not loan into property you to definitely belongs to a great deal more than anyone.

If you have poor credit, you will have difficulty protecting an area loan. In case your credit is not one thing, your loan eligibility is dependent upon the kind of property you very own and its venue. For those who individual primary property which is zoned having commercial have fun with in the a busy city, the loan features a good chance of being acknowledged. If it’s discovered quickly brand new highway, your chances was even better.

not, for folks who own a few outlying miles faraway from an effective urban area cardiovascular system, searching for a loan provider could be challenging. The lending company wants at the land’s profits, meaning just how with ease it could be changed into cash if you default on your own mortgage. In the example of outlying possessions, you have got most readily useful luck having a tiny regional lender than simply a larger place. A region banker will get top understand the property value your belongings.

After you’ve identified a lender in addition to lender has actually affirmed that the homes is valuable sufficient to serve as guarantee to have your loan matter, it will be possible to do the loan techniques into the following the tips:

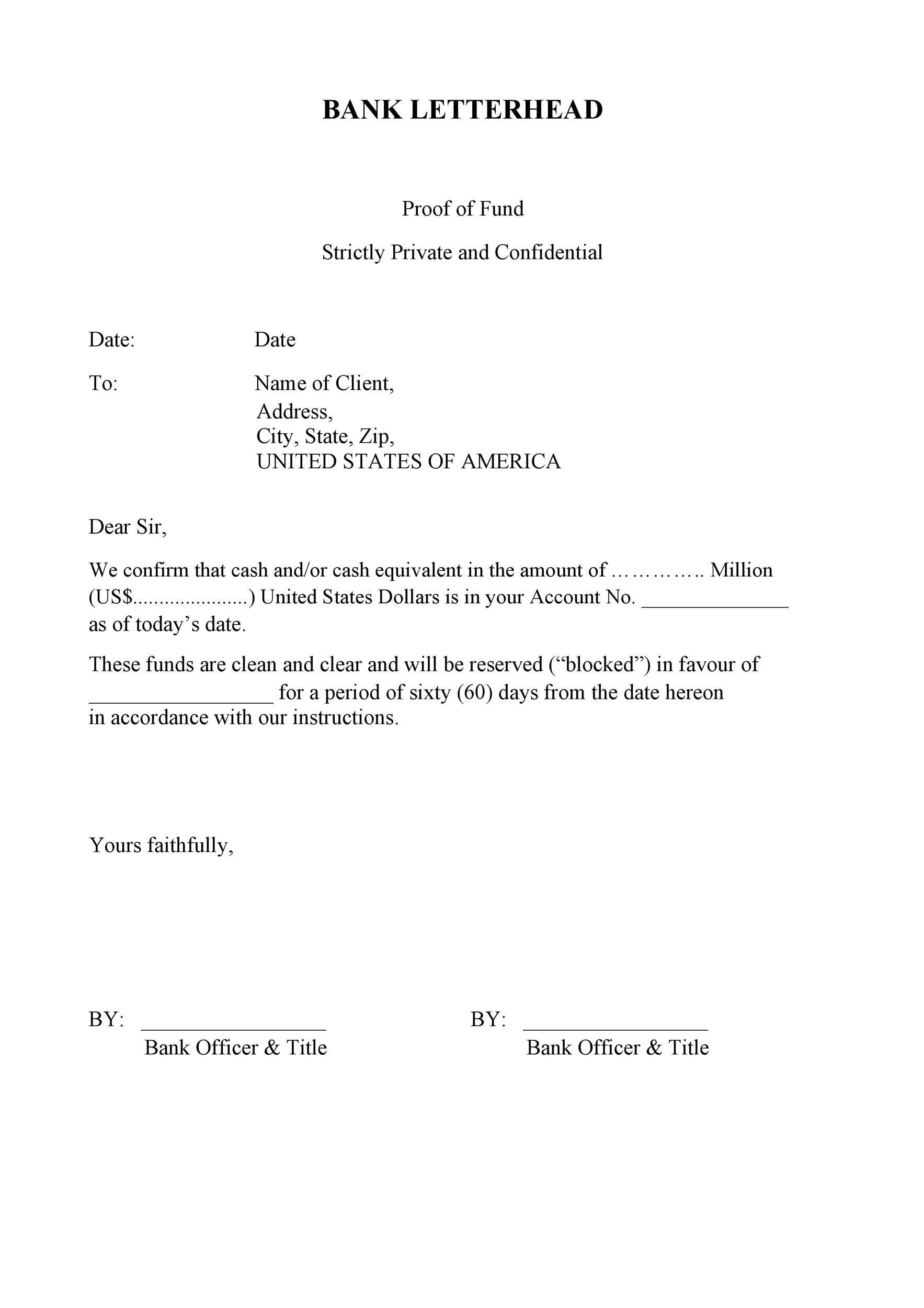

- You will need to tell you the financial institution evidence you own the fresh new home.

- The financial institution will ensure there aren’t any existing liens otherwise bills for the deed.

- The lending company get get a third-party a property appraiser to select the value of the brand new property. If your financing is actually for over $250,000, new assessment must become official to own accuracy.

If these types of actions are completed to the fresh new lender’s pleasure, the financial institution will likely then talk about the terms of the borrowed funds they are prepared to bring. Once you additionally the bank possess offered to the latest terms and conditions and you will the loan are awarded, the financial institution have a tendency to list good lien on your residential property label.

Ought i obtain a loan into the vacant house?

Loan providers generally speaking come across bare house due to the fact an excellent riskier financial support than simply property which is currently being used. Structures can be marketed otherwise leased aside, even though it usually takes extended to possess unused belongings to help you generate any cash circulate. Once more, you have got finest luck with a neighborhood bank than just with a massive one.

For individuals who seek to use the bare home given that guarantee to own that loan to pay for a property opportunity into the possessions, which is yet another facts. The lending company will consider the new economic fuel of endeavor, and you will, if this enjoys exactly what it finds out, it does disburse loans as you meet your own structure goals.

Think about financing facing a secure believe?

When you are seeking financing resistant to the assets of an area trust-titled an area believe financial -you will have to look at the believe action to ensure the new trust has got the power to borrow funds.

Should your house is already within the a land trust, while should borrow against the beneficial desire, then the lender will need to suffice what exactly is called a great “See away from Collateral Assignment” on your trustee. Their trustee will must generate a keen “Bill of the Assignment” in response. A www.paydayloansconnecticut.com/baltic short while later, new trustee will be unable to transfer new name regarding any possessions kept in the trust with no lender’s composed consent.

What happens for many who standard to the an area financing?

Just as with people financing, you ought to repay a secure mortgage with respect to the terminology of one’s loan bargain. For many who standard to your financing, the financial institution usually takes possession of the homes and sell it to pay for the total amount you owe.

At the same time, once you pay off your own homes loan’s full matter, the bank usually cancel the fresh lien on your own deed. Yet, the lender doesn’t have subsequent state they the property.