House Guarantee Money

Are you contemplating tackling a primary renovation? Brand new security on the St. Charles home will be the key to investment. Your house shall be an invaluable monetary investment. You need to use your residence equity loan to settle high-attention costs, financing their newborns studies or protection a crisis bills.

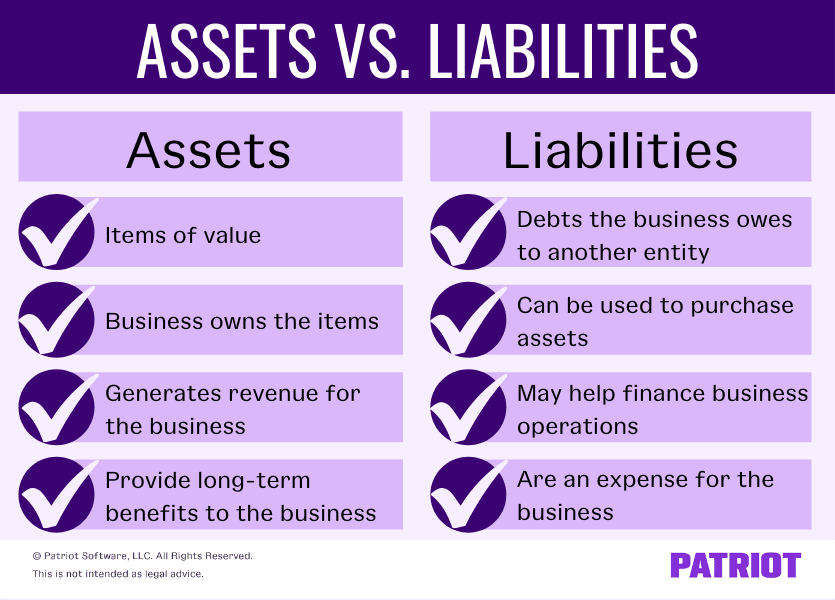

It can also be called an equity mortgage , otherwise a house collateral repayment loan . Family collateral loans are a way to own home owners to borrow against the latest guarantee within house. New homeowner’s newest mortgage equilibrium, and also the home’s really worth, determines the amount of the loan . Home collateral fund usually are fixed-rates . But not, property guarantee personal line of credit otherwise HELOC is much more preferred and contains an adjustable interest rate .

A good St. Charles house guarantee mortgage has some will set you back that you should consider. These are typically the newest closing costs , interest rates , appraisal fees, and you may terms. This short article promote a comprehensive article on house guarantee funds as well as their positives therefore the will cost you. Before applying to own a home equity mortgage , definitely comprehend all the conditions and terms. Then you may determine whether that loan to your house equity is the right option for your.

Interest

The borrowed funds calculator will assist you to estimate the interest rate with the property equity mortgage . This equipment brings data out-of a number of America’s most esteemed banks and you will thrifts. An excellent $31,000 loan could easily be computed using an 80 per cent loan so you’re able to well worth ratio. The borrowed funds-to-value proportion (otherwise LTV) compares the amount of the financial with the home’s well worth. Lenders require that you possess equity of your house, hence money try factored in the approval processes.

The first rate of interest to own St. Charles domestic guarantee money is affected by of a lot activities, together with your money and credit rating . The average annual percentage rate having a house security mortgage was five %. Pricing can vary based on your area and financial . If you would like higher loans to cover significant upfront expenses, eg college tuition, property collateral mortgage could https://cashadvanceamerica.net/title-loans-wa/ be the best bet. House equity loans want rates that’s typically high than just a first mortgage because it’s 2nd on the range. Pricing to possess St. Charles domestic guarantee funds try varying and often lower than those out of earliest mortgage loans. The first interest rate to possess property equity credit line is actually lay by the lender and can alter considering industry criteria.

The interest rate to possess property equity mortgage can vary dependent towards your location found. The house guarantee loan rate of interest having Boston people ‘s the lowest when you are those in new D.C. metropolitan part have the higher. Since , an average domestic equity mortgage rate of interest from the D.C. urban town was 5.20%pare domestic security loan interest rates round the urban centers to discover the best.

House equity financing are a good option if you’d like disaster bucks. Select the fresh new charges and you will terms and conditions. The interest rate on a house guarantee loan shall be affordable, and repayment terms and conditions would be to do the job. Low charge are important. Check out information about home collateral loans regarding lenders’ websites. Famous is that the of a lot financial institutions have tightened up lending principles and briefly suspended household equity facts during the time this information is typed.

Bank Term

Domestic equity finance have an expression that will start from 5 to thirty years. The borrower’s requires and requires is also determine whether the borrowed funds term is expanded otherwise diminished. Even more repayments can be produced and/or financing refinanced to give brand new fees terms. Situations are widely used to calculate the pace. These circumstances is actually set in the entire attract paid off across the financing label. How many fees or activities will have an impact on the speed and you may percentage name.

A unique component that is influence your choice to acquire a home guarantee financing is your debt-to-earnings proportion. Your debt-to-earnings ratio (DTI), ‘s the level of your revenue one equals your own month-to-month bills. Whether your financial obligation-to-income proportion is lower, you really have a better risk of taking a loan who has a lengthier installment several months. A reduced DTI have a tendency to end in a reduced desire. Before you apply to own a St. Charles home security home loan, make sure to have sufficient collateral in your home to track down a good rate.

As to the reasons score property collateral mortgage?

You can use the fresh new collateral of your house to settle expense otherwise acquire monetary cover. Property equity loan makes you make use of the residence’s worthy of to help you consolidate numerous expense with the that mortgage . The financial institution will usually provide your a lump sum payment count in the a fixed rates for a selected name. It can save you money having fun with house collateral financing to switch your own budget. Household guarantee loans are usually lower than credit cards.

You may want to borrow money to finance higher strategies particularly house renovations. The latest collateral of your property will likely be reached versus refinancing and you will you could make monthly payments into the lasting. Prior to signing into the dotted, be sure that you can pay for the monthly obligations.