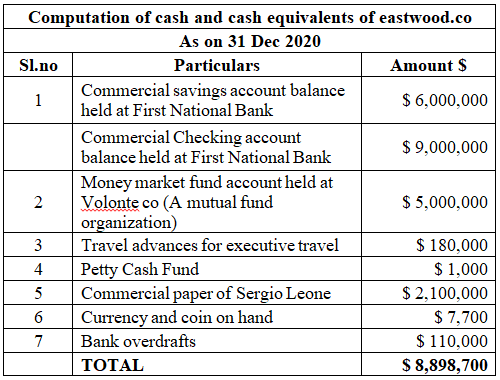

Lea Uradu, J.D. is actually good Maryland Condition Inserted Income tax Preparer, State Official Notary Societal, Official VITA Taxation Preparer, Internal revenue service Annual Filing Seasons Program Fellow member, and you will Taxation Author.

With a zero-closure prices financial, the newest borrower will not spend closing costs at closure. As an alternative, new closing costs is folded to the equilibrium of one’s financing, or the lender usually costs a high interest to the mortgage.

Closing costs typically become financial charge, recording charge, taxes, house assessment can cost you, and. A debtor usually can anticipate paying a number of thousand dollars in conclusion can cost you. Whenever they decide for a zero-pricing financial, either described as a no-commission financial, they save money from the closure but pay much more throughout the loan.

Key Takeaways

- Settlement costs make reference to expenditures from to get or refinancing a property.

- A no-closing-rates financial is actually for an alternate house or refinancing, where the settlement costs try rolled with the equilibrium otherwise attract rates out of that loan.

- You’ll end up with increased interest rate and most likely good bigger home loan, which means this won’t be ideal for anyone.

- Opting for how exactly to spend their settlement costs is an essential part regarding choosing whether or not you really need to re-finance or not.

Exactly what are Home loan Settlement costs?

When you take out a mortgage (both having a buy otherwise a great refinance), it is possible to pay individuals expenses, a lot of them the next inside our closing rates guide. Some of the most well-known are:

- Financial charge

- Government tape fees

- Establishing a keen escrow make up taxation and insurance coverage

- Costs for a property appraisal

Fundamentally, closing costs was paid back if mortgage arrives towards debtor. Some are paid back because of the vendor, with most paid back because of the buyer. A no-closing-costs home loan are a buy or refinance where you do not pay any settlement costs at the time of the latest loan’s discharge.

And have no or lowest will set you back during the time of closure music great, don’t forget that in the event the something musical too good to be real, they probably try. You’re still planning to shell out those individuals will set you back-down the road.

Really terms of the mortgage was flexible, precisely how this type of prices are repaid was right up getting discussion anywhere between your bank. Loan providers and you will mortgage brokers aren’t effective at no cost, too many of these points still have to be taken into account. For the a no-closing-prices financial, lenders typically recover such costs in just one of several indicates. One-way is to incorporate these to the main harmony from your new loan. The other way is by the battery charging increased interest so you’re able to perform a no-closing-pricing re-finance.

Whether or not to re-finance your own financial is a complicated decision, and address can vary according to per disease. The way to decide if you ought to re-finance is to manage the newest number. Glance at the complete one to-big date closing costs which you yourself can need to pay, then compare one amount towards amount it can save you each month with your homeloan payment. If it will set you back you $2,000 in order to refinance while save your self $2 hundred with each percentage, then you’ll definitely pay those individuals will cost you inside 10 months.

You are able to do an equivalent sorts of research whenever determining if you can make use of a no-closing-costs financial re-finance. In this case, be sure to look at just how moving the fresh new closing costs towards the loan influences your own monthly payment. You need to ask questions instance, Could it be worthwhile in my opinion to spend $step 1,000 today to store $25 per month for the remainder of the expression out of my financial?

That have a sense of how long you want in which to stay your existing domestic also may help inform your choice-and also make procedure. Even though you can’t say for sure if your state normally unexpectedly change, a good re-finance renders quicker experience for many who know already that you’re considering transferring a couple of years. Since most refinances maybe you have pay specific right up-front can cost you in exchange for lower monthly payments, if you intend to keep merely temporarily, following and work out straight back those individuals 1st will set you back would-be tough.

Zero, closing costs is independent on the downpayment. It include lender costs, bodies tape charge, home appraisals, and you will fees getting setting-up a keen escrow account.

Yes, your bank commonly discuss closing costs and can always make you the option to move all of them to your loan’s equilibrium otherwise spend them in the closing.

How much cash Try Closing costs?

According to Fannie mae, closing costs are usually 2%-5% of one’s property value your own home loan. Instance, if you are to get a $3 hundred,000 home and placing off 20%, your closing costs usually range from $eight,000 in order to $9,000.

The conclusion

A no-closing-rates home loan azing package initially, but a better examination reveals possible downsides. For just one, settlement costs you should online payday loan Colorado never disappear completely-people charge are only obtained subsequently. Work on brand new wide variety. See just what the offer will definitely cost as well as how far you’ll save monthly. To help you result in the most readily useful monetary choice for your condition.