To shop for yet another household and buying a parcel – if you find yourself one another is generally known as to shop for possessions, discover crucial variations to adopt, specially when you find funding. Why don’t we mention the ins and outs from patch money and you will home loans and therefore allows you to understand its distinctions that assist you decide on the most suitable option to suit your property needs.

Particular loan

An important difference between a mortgage and you may area financing lays regarding the undeniable fact that a land mortgage try created specifically to possess to invest in residential residential property, while a mortgage is usually used into acquisition of home-based dependent-right up otherwise lower than-structure property. When a plot is purchased using a land financing, there isn’t any fixed schedule given for its have fun with since the a residential family, although the appointed use was exclusively to own residential purposes. On the contrary, which have a home loan, candidates feel the independence to make use of the borrowed funds number for buying a house or the development out-of a domestic strengthening.

Taxation Professionals

For people choosing a home loan to possess a completely oriented domestic possessions, tax benefits arrive into the the interest commission and you may prominent matter. Having said that, somebody delivering a plot mortgage don’t have access to tax advantages. The actual only real income tax deduction designed for a story is for this new loan amount gotten to possess creating build in it.

Mortgage to Worth Ratio (LTV ratio)

The mortgage amount which might be obtained up against a house is denoted because of the Financing-To-Value (LTV) proportion. Due to the domestic security associated with the a mortgage, the newest LTV is high to that particular out-of a land financing. To own loans below 31 lakhs, new LTV can be as high given that 90%, whereas to have patch fund, it is restricted to 70%. Thus, regardless if you are considering buying homes for personal fool around with otherwise financing, the absolute minimum part of the cost will need to be repaid initial.

Period of the Loan

The loan period and you will EMI are crucial facts in almost any financing application. In comparison to a story mortgage, a mortgage usually has a longer period. Often times, the go to these guys latest period to possess home financing can also be stretch up to 31 decades, when you find yourself to have a land financing, the most tenure ong other banking companies and you can loan providers.

Version of Possessions

In the example of home loans, simply qualities meet the requirements getting financing. These types of functions may include freehold resale homes, creator apartments, or regulators-approved houses systems. Lenders are not appropriate so you can features categorized as the farming or industrial. Similarly, area loans are merely readily available for home-based residential property. New plot’s place have to be inside civil or area constraints, maybe not within a community. Just like lenders, plot financing can not be received into acquisition of agricultural or commercial property.

Rates

The eye costs to possess plot money is higher in comparison with home loans. Currently, home loans come at around seven.50% yearly, whenever you are patch financing range between 8% and you will ten% yearly. Which highest pricing for patch financing is due to this new relatively greater risk it pose. Banking companies provides conveniently saleable collateral that have lenders, making it easier so they are able get well losses if required.

Making the Solutions: Area Financing Versus Financial

Whenever choosing between home financing and you will an area mortgage, it is required to consider your personal needs and you can hopes and dreams. While you are trying a ready-produced possessions, home financing also offers a simple solution. Alternatively, for those who have an eyesight having building a definite home, a plot mortgage could be the finest complement.

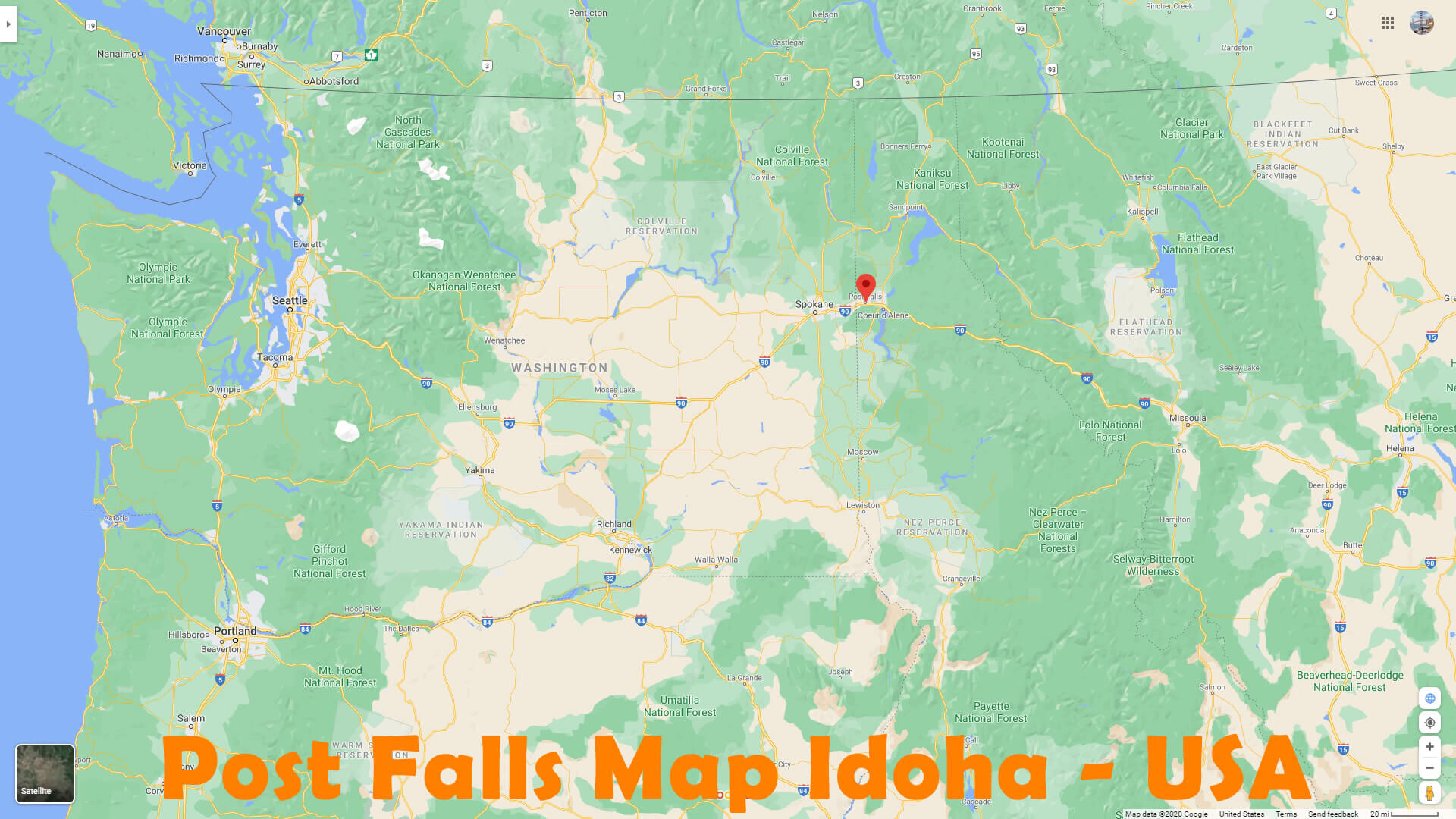

The distinctions between a land financing and you may a home loan try several. However, they are both crucial inside the fulfilling your house ambitions, whether it’s for plots in the Madhavaram, plots inside Vandalur otherwise one the main nation. Both these fund serve collection of purposes and provide different words and you can positives. So, it is tall so you can cautiously evaluate your position, economic condition, and you may upcoming objectives and also make a highly-informed selection. If choosing a plot mortgage otherwise a home loan, selecting the most appropriate option can pave the way to the latest fulfillment of property ownership.