Zorica Loncar

As much as possible safe a beneficial 10% to own a down payment to suit your basic family, after that your credit score shall be ranging from five-hundred-579. In case your credit history are more than 580, then you certainly only need step 3.5% to own a downpayment.

One choice is to cover your down-payment from your deals. However,, you might even get a grant because the off-commission guidelines.

As the offer may appear great at basic look, due to the fact a borrower, possible still need to pay for financial insurance costs also known as MIP. The insurance provides to protect the lending company in the event of a great unsuccessful payment.

Nevertheless, this might be a little a popular selection for many people once the good prime credit score isnt wanted to apply. Whenever anything goes wrong, the financial institution commonly first document the newest allege to the FHA so you can collect the new percentage. Since the lenders have this solution, loans Smeltertown CO they might be very likely to make it easier to money very first family.

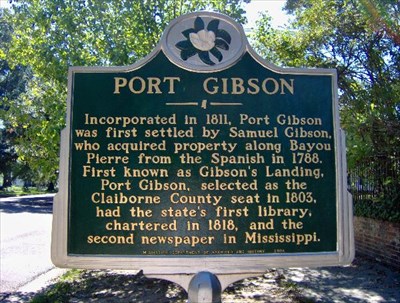

The historical past out of FHA

The newest Federal Property Work, and that noticed the brand new light out-of big date in the 1934, was good for the newest institution of your own FHA as an organization. At the time, almost 2 mil individuals destroyed their jobs regarding design business. And simply cuatro regarding ten house just weren’t actual tenants.

The theory about FHA will be to let low-earnings Us citizens buy the very first homes. During these beginning level, they worried about helping conflict experts as well as their families.

From inside the 1965, the brand new FHA turned into part of the brand new American Department from Houses and Urban Development’s Work environment. Ever since then, the manufacture of brand new home has brought regarding. It worried about houses elderly people and you may reasonable-earnings People in america first.

By 2004, the latest homeownership was at a most-day large (69.2%). However,, subsequently, this has been shedding each year until 2016. One seasons met with the low rates since the 1990’s (63.7%). From inside the 2019, the new homeownership price in the us is 65.1%.

At this time, the fresh FHA provides about 8 million unmarried home mortgages. That it institution and additionally protects twelve,000 mortgages to own multifamily features. Among them is actually 100 mortgage loans for scientific establishments.

Various style of FHA fund

Individuals make use of the antique FHA home loan to invest in an initial lay out of residence. Besides this that, there are other type of FHA money available. They’re:

- domestic security conversion financial system (HECM)

- 203(k) mortgage system

- energy-effective mortgage system (EEM)

- part 245(a) loan

Family guarantee conversion process financial program (HECM)

Family collateral transformation mortgage (HECM) is actually an other mortgage made for individuals over 62 yrs old. It’s a program that allows the elderly to utilize the new security in the your house they’ve for day to day living expenses.

An individual chooses just how might withdraw the bucks. It could be a credit line, a fixed monthly count, otherwise a mix of one another. An additional benefit is because they don’t need to pay-off the mortgage up until they promote the house.

It helps during the a difficult financial situation, however, someone have to be careful. It isn’t rare you to definitely earlier consumers feel subjects away from fraudsters. Brand new con artists will generate suspiciously a good offers, including totally free or really cheap domiciles. Nevertheless they posting emails in order to elderly people asking for cash in replace for the majority data files they can get for free. Possibly the FBI blogged an alert and you can offered guidance so you’re able to possible otherwise latest sufferers.

203(k) financial program

The brand new FHA 203(k) upgrade loan is also referred to as FHA structure loan otherwise rehab mortgage. It helps consumers buy and upgrade a property immediately. It may also shelter the brand new solutions and home improvements of the property you currently individual. The drawback for most is you need to use a beneficial professional company, you can not perform some really works yourself.