11) Short-identity balloon notes. ( Things below 7 decades on the property, people balloon mention on a customers advantage such an auto.)

12) A routine or practice of lending based on foreclosure property value property (debtor maybe not relatively probably make money predicated on earnings and/and other property). Get a hold of OCC 2003-dos. To manufacture you to definitely commitment you have got to come back toward new loan software.

13) HELOCS: Check house security line of loans and you will eliminate the initial loan applications. Did the new borrower in the first place submit an application for something similar to $5000 to fix new roof, and you will ended up with a good $fifteen,000 line of credit, without any papers throughout the borrower documenting a choice/ purpose to make use of the fresh personal line of credit? Brand new HOEPA legislation altered by , and you will auditors are seeking such issue.

This will leave you a thought. Additionally it is a great amount of work to pull account and financing data. Getting county-certain statutes/regs are the new BOL state message boards.

Thanks for the recommendations – thus giving me personally good starting point. We’re anywhere between Conformity Officers right now but I will get Review inside – they truly are extremely happy to help you on the any systems which come collectively.

In addition, for folks who start to see things that will get present a prospective matter, you can document them and also have the bank to create from inside the a conformity officer/firm going after that

Better, if i helped I’m pleased, as you sounded quite concerned and you may I have gotten plenty of help me personally on this subject discussion board.

But I just need certainly to let you know that I would not think me qualified to accomplish that style of survey, and you will suggest that you consult an experienced conformity people. Such relies on personal things, a whole lot relies upon perspective, and so much will depend on translation/regulating umbrella which i think it requires a professional. Commonly it’s all in the way this new files try noted.

Beginning , financial institutions had been plus expected to bring particular disclosures to consumers to own higher level and you may fee loans which were at the mercy of House Control and you will Equity Safeguards Work of 1994(HOEPA). Brand new scope to possess choosing a great HOEPA includes next:

Rate of interest Lead to: Apr in the consummation exceeds 8% of equivalent Treasury Bonds having basic lien money, otherwise ten% to possess under-liens

In case the financial did not “relatively anticipate to make proceeded enhances” while the unique consult would online West Virginia title loans have been a good HOEPA mortgage, it a beneficial HOEPA solution

Paid Bring about: Overall points and you will fees exceeds 8% from overall amount borrowed, or $488 almost any ‘s the better

Aside from the speed and you can commission base relevant, these are particular questions to assist you to locate a great start:

step 1. Could you be and work out that loan that’s secured because of the an effective 1-cuatro family members hold this is the top household of the consumer? Yes

I must wake up in order to speed very quickly about this. I am trying help somebody who found myself in chaos and you will today by doing nothing –assertion out-of being also terrified to face reality??–they are it is therefore even worse.

About what I am studying it claims you to possibly really the only solution to victory financing modification is by demonstrating a case regarding predatory lending.

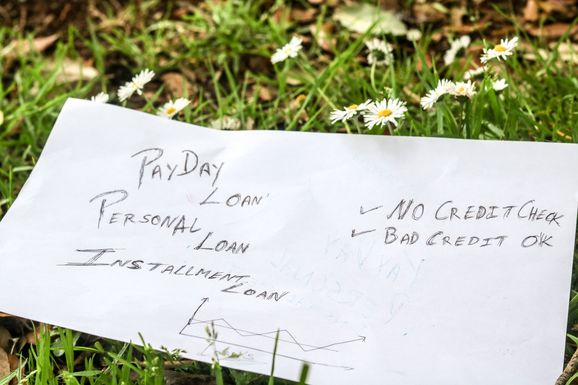

Predatory credit strips borrowers out of household security and you may threatens parents having foreclosures. Have a tendency to consumers is cheated towards the accepting unjust mortgage terms, constantly as a result of competitive conversion process projects. Commonly they are taken advantage of due to their decreased understanding of terminology and you may engagement during the challenging purchases. Way more advised people are occasionally fooled. Anecdotal guidance ways predatory credit is targeted inside the bad and fraction communities, where best loans are not available.