Spring season is the perfect returning to a brand new begin, not just in your home, but for your money too. Regardless if you are preserving having a new house, planning for the future, or simply just applying for your finances back on track, providing power over your bank account helps you stay on most readily useful of the economic requires. Here are six points so you’re able to spring-clean your profit and set oneself right up to have a financial start.

Step 1: Declutter their papers

Effect weighed down by files cluttering up your processing drawer otherwise exploding from your own table compartments? Start by sorting through your data files using this type of decluttering method:

- Keep otherwise dispose of. Divide their paperwork into one or two independent hemorrhoids: documentation to save and you may documentation so you’re able to throwaway. One thing low-delicate should be recycled or discarded on your trash range.

- Archive important information. File data such delivery permits, medical records, tax data and courtroom papers in the a filing closet otherwise envision setting-up a beneficial environmentally friendly field – a box, shops cabinet, lockbox otherwise an electronic document where all important files was leftover safe.

- Electronic filing and you may shops. Check your own very important records and shop them on the net to attenuate disorder making it simple to access.

- Shred sensitive pointers. To protect your self up against id theft, safely dispose of sensitive guidance you no longer need, such as for example dated financial statements otherwise dated costs, playing with your own shredder or good shredding facility.

Step two: Change to electronic comments

While you are sick of the brand new limitless stream of papers bills and you can statements striking your letterbox, then it is time and energy to go electronic! Very financial institutions and you will services supply the option to change to digital comments instead of paper so check with your organization and you can make alter. Not merely really does supposed digital help to lower report disorder which help you be much more organized, it’s also an eco-friendly alternative.

Step three: Feedback your credit score

It is https://paydayloancolorado.net/fountain/ worthwhile doing so at least one time a year. Around australia, you could potentially request a copy of one’s credit report out-of big credit agencies eg Equifax, Experian and illion. Daily examining your credit score allows you to choose:

- Missed payments you weren’t aware of

- Borrowing membership you don’t apply for

- Incorrect personal information

- Less than perfect credit so you can take steps to repair they

Step four: Improve your passwords

Cyber-offense is rising, with additional expert and convincing cons threatening monetary shelter. Maintaining your economic levels safer is much more crucial than before! Review your own passwords boost any that can be compromised. Consider utilizing a password manager to save your own passwords and place right up two-foundation authentication for additional safeguards.

Action 5: Personal vacant profile

Personal information for the old, unused levels you can expect to nonetheless provide cyber-bad guys with approaches to your own cover questions to your most other other sites. Manage your privacy by detatching personal analysis out-of services you zero prolonged use. Intimate people so many or empty bank accounts otherwise credit cards so you can clear up your finances and get away from people charge.

Action six: Remark courtroom files

If you’ve experienced big lifestyle alter, particularly getting married, divorced, otherwise that have pupils, it’s essential to update your commonly. Be sure most of the info, and target, assets, beneficiaries, and you will executor, are nevertheless right and you may related.

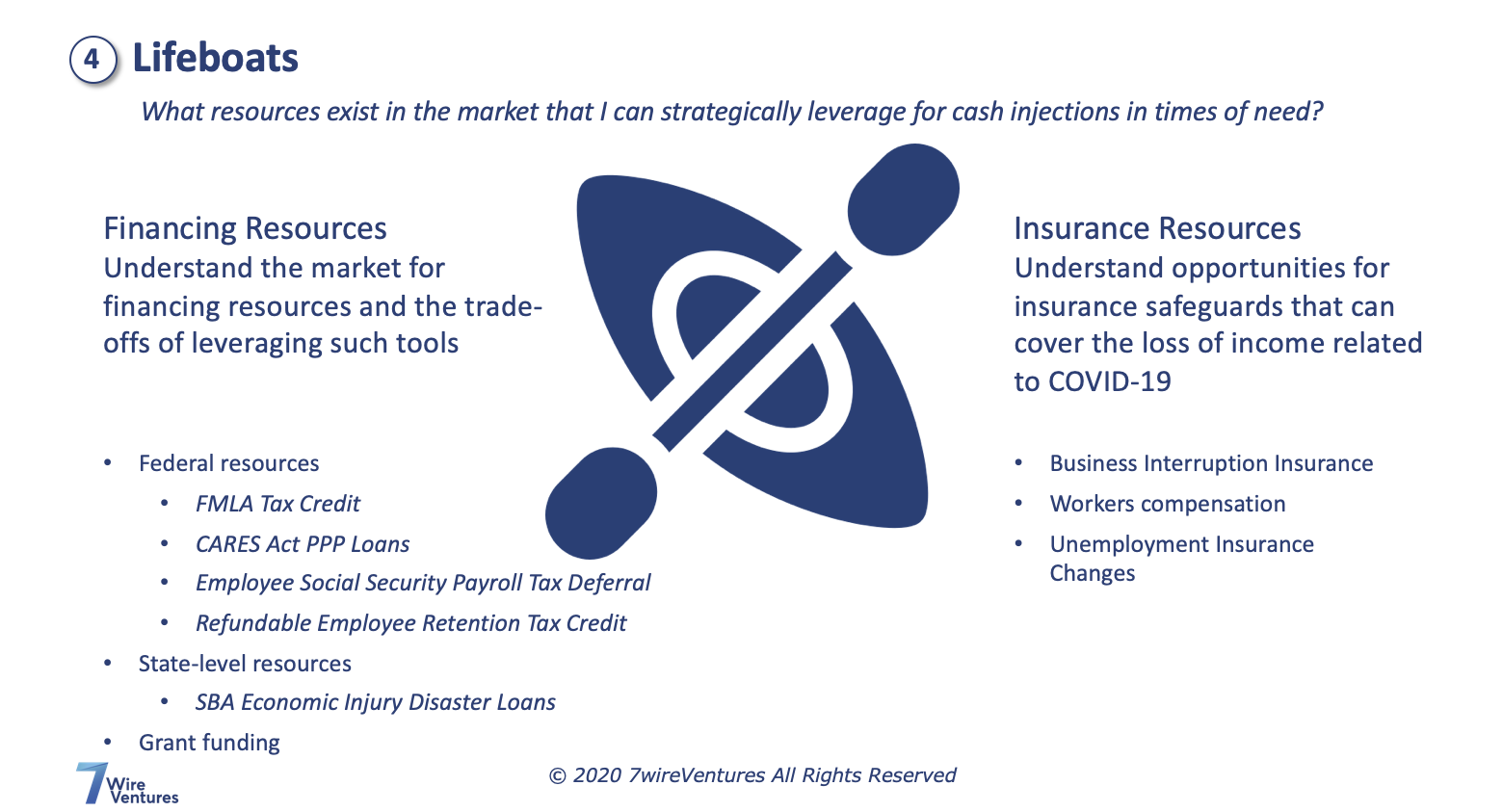

Opinion your own insurance coverage to make certain they have been up to date and you may nevertheless fit for mission. Get advice away from a smart Insurance agent to check you’re not purchasing safety there is no need or that you’re not underinsured.

Simple steps so you’re able to achievements

Spring-cleaning your bank account doesn’t have to be tricky. Just a few easy steps helps you get the cash under control. For much more information and recommendations regarding budgeting, debt consolidating or monetary thought, get in touch with a home loan Display money associate and also have let keeping your cash focused.