The vendor invoice will include details on the quantity of goods or services, the price, payment terms, and a due date, such as net 30. The proper accounts payable procedure begins with a good chart of accounts, which enables you to post your expenses to the correct account. The process is complete when you issue a check or electronic payment to the vendor for the amount due on or before the stated due date. So whether you prefer the speed and security of digital payments or the familiarity of traditional checks, it’s time to leave siloed workflows in the past. A Chief Financial Officer (CFO) or Controller typically signs approved checks, but that person shouldn’t be the one assembling the check run.

Accounts payable, also known as AP, are the total debts that you owe to other businesses for goods or services that they invoiced you for. Assigning codes organizes accounts payable processing so you know when to expect payments. Using accounting software for this step allows you to automatically track payment terms and assign payment due dates. Inefficiencies and gaps in the AP check run can turn a straightforward process into a headache.

If you have an approval process in place, such as requiring a manager’s signature, do so before the invoice is approved for payment. A purchase order is a document sent to a vendor or supplier to request goods or services. It includes details such as the quantity of items, the price, and the delivery date. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market.

Both accounts payable and accounts receivable are vital parts of the accounting process. Accounts payable, as explained above, are what is owed to suppliers or service providers for products received or services rendered. Accounts payable are considered liabilities, since it is money that is owed. Some companies use a voucher in order to document or “vouch for” the completeness of the approval process.

Step 4. Process payment for outstanding invoices

After the receiving report and purchase order information are reconciled, they need to be compared to the vendor invoice. Hence, the receiving report is the second of the three documents in the three-way match (which will be discussed shortly). You’re likely to get a call from your supplier, which could jeopardise your reduce your taxable income supplier relationships if you’re not careful. In fact, 90% of AP department workers said they regularly received calls from suppliers chasing payment. Let’s take a look at an example of the accounts payable process in action.

How To Streamline Your Accounts Payable Process for Better Cash Flow

When the vendor invoice is paid, the voucher and its attachments (including a copy of the check that was issued) will be stored in a paid voucher/invoice file. If paper documents are involved, an office machine could perforate the word “PAID” through the voucher and its attachments. If you’re unable to pay an invoice by the supplier’s deadline, typically within 30 days, they may be able to extend the due date. In accounting, this reclassification is known as a “long-term note,” which is basically a drawn-out IOU. If you do find yourself in this situation, it’s a good idea to be transparent and communicative with suppliers. Remember, your payment not only applies to your own finance management, but it also impacts their finances.

Step 3. Invoice approval

- A purchase order gives both you and the seller a clear understanding of what is being bought and the terms of the transaction.

- Using accounting software for this step allows you to automatically track payment terms and assign payment due dates.

- Only when the details in the three documents are in agreement will a vendor’s invoice be entered into the Accounts Payable account and scheduled for payment.

- If you use accounting software, you can enter invoice details, the amount due, and the date due, and choose to pay those invoices when the payment is due.

- Authorized approvers, customized workflows and added security such as positive pay will help reduce the risk of payment fraud.

Make sure to have a system in place for each payment workflow step within your accounts payable process. Authorized approvers, customized workflows and added security such as positive pay will help reduce the risk of payment fraud. A “check run” or “cheque run” refers to the most important step of the accounts payable process where payments are approved and executed in order to pay invoices in a timely manner. Check runs can be processed either as a batch of payments, or as individual payments. Historically, they are defined as payments by paper check, however today, the term also applies to electronic payment processes. The supplier or vendor will send an invoice to the company that had received the goods and/or services on credit.

If you don’t pay by December 24, the full amount of the invoice is due by January 14 at the latest. On the other hand, accounts receivable (A/R) is money owed to you for goods or services you provided to your customers on credit. Accounts receivable balances are considered an asset, as that number indicates how much money is owed to you by your customers. Knowing this number comes into play when digging into deeper business insights by calculating your accounts receivable turnover. When accounts payable items are paid, the accounts payable account is debited, with cash credited. In fact, 51.6% of survey respondents noted that this process was either their biggest or second biggest obstacle to converting more AP spend into digital payment methods.

This means that you expect to pay the amount within one year, contrary to long-term debts like loans, which may take years to pay off. Technically, the amounts are debts, not expenses because the funds never reach your income statement. Instead, accounts payable only appear on your balance sheet as current liabilities. Once you’ve completed these steps, it’s time to update your books to reflect the most current information. After a vendor payment has gone through, you can remove it from your list of accounts payable.

A mobile app is also a great way to gather authorized signatures, if paying by check. A poorly run accounts payable process can also mean missing a discount for paying some bills early. If vendor invoices are not paid when they become due, supplier relationships could be strained. If that were additional paid in capital to occur it could have extreme consequences for a cash-strapped company.

By this point, you probably know that implementing an accurate accounts payable process is key to keeping your finances in check and making sure payments don’t go missing. But it’s no lie that it can be a time-consuming process that needs streamlining. The first step of the accounts payable process is to create a chart of accounts, which is an organizational chart that summarizes where you record accounting transactions. You can also automate the accounts payable process by setting up approval workflows and payment schedules. Wave Accounting offers free accounting software with accounts payable features like invoice tracking, bill payment and automatic reminders.

Use the links below to navigate our guide, or read through for a detailed overview of the accounts payable system. The accounts payable process plays an important role in your business’s accounting operations for several reasons. There are many moving parts to keep track of when taking care of your business’s accounting, and the accounts payable process is one of the most important.

If you’ve just started your business, you’ll likely have to set up your vendors. Whether you’re tracking accounting transactions using spreadsheet software or accounting software, you’ll need to record vendor details. Platforms like MineralTree allow teams to schedule payments in advance, even for checks.

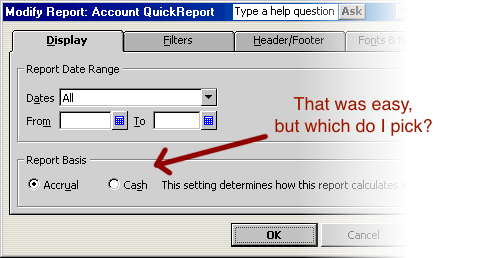

Accounts payable only applies to businesses that use the accrual basis of accounting, not cash-based accounting. This is because the accrual method of accounting records income and expenses when they are invoiced and paid. Accrual accounting uses invoice processing to both procure and offer services on a credit or debit basis, rather than requiring payment to be made in real time.

Hence, small companies without sufficient staff to separate employees’ responsibilities will have a greater risk of theft. If you notice an error on an invoice, contact the supplier or vendor as soon as possible to address it. Resolving the issue can mean requesting a corrected invoice, disputing the charge, or requesting a credit. Check out our reviews of the best bookkeeping software for small businesses.

Die Kombination aus vernünftigen Preisen und hervorragendem Handwerk positioniert bestuhren.de als führenden Anbieter von Replik-Uhren, der speziell auf die Vorlieben des deutschen Marktes eingeht.