Faqs

People family equity line of credit (HELOC) contact info reputation including emailing address, contact number, and you will email address need to be filed on paper.

In case the financing was once maintained of the GMAC Mortgage – or perhaps is already serviced by OCWEN (now-known just like the PHH Home loan Functions) – you can contact PHH individually from the 1-800-390-4656.

A maturity see is alerts that house collateral line of borrowing from the bank (HELOC) mortgage try handling its readiness go out. Because the mortgage reaches one go out, the rest amount owed on the mortgage is born. The brand new observe gives guidelines on precisely how to pay-off the brand new complete level of the mortgage.

Called good HELOC, that one allows you to set up a personal line of credit you could obtain regarding on an as-necessary base, similar to a charge card. This type of personal lines of credit have a tendency to ability adjustable rates of interest, meaning the pace commonly change throughout the years as a result so you’re able to business alter. The borrowed funds usually are paid down over a decade.

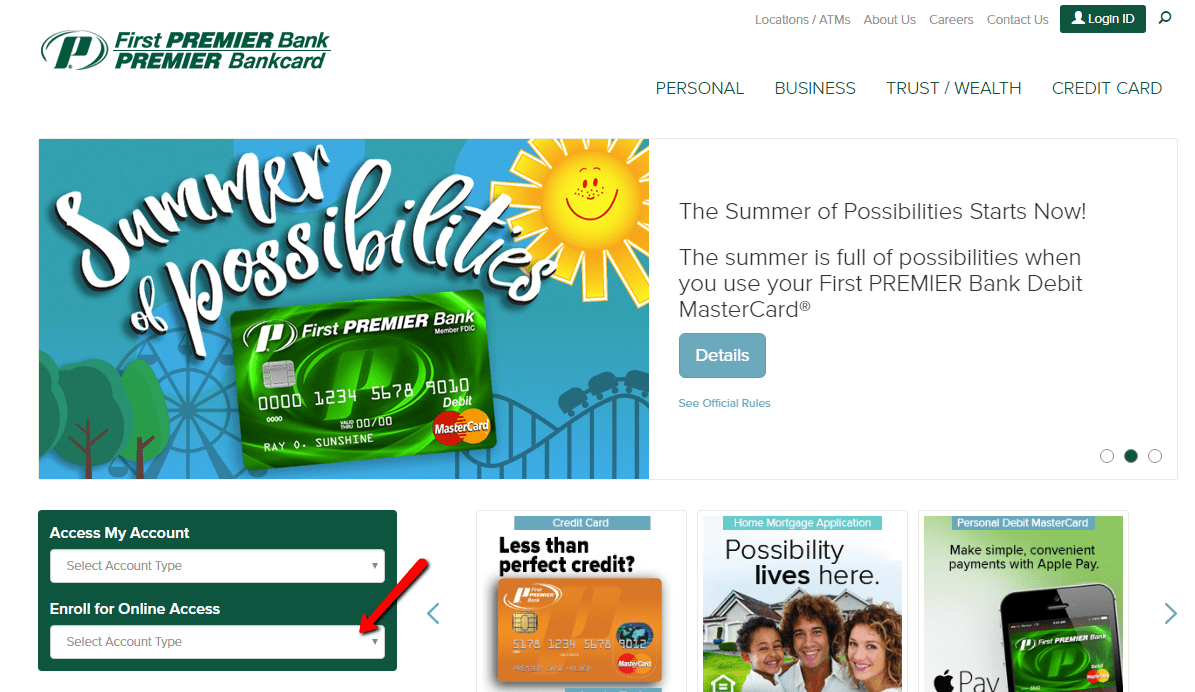

Sign in and select Create Account from your own Picture. Next, see Membership Administration following Document Center. From there, favor Paperless Statements as your delivery preference.

Any household collateral line of credit (HELOC) contact information position also emailing target, contact number, and you will email address have to be recorded on paper.

A conclusion away from mark find is alerts the draw (or discover) age of your home security personal line of credit (HELOC) mortgage is actually conclude, and you will probably now getting entering the installment (otherwise closed) several months. As soon as your financing goes into the new repayment period, you can easily no further be permitted to generate enhances. Continue reading