Household Depot, Inc. (HD) and you will Lowe’s People Inc. (LOW) have been the newest giants of the property upgrade store world in the the You.S. for a long time, for each performing up to 2,2 hundred locations, each with more than 100,000 square feet away from merchandising area. Each other shops go after an equivalent sector, but their advertising and offer-chain tips are very different. By 2020, the typical Home Depot store enjoys in the 105,000 sqft of shut room and throughout the 24,000 square feet from outdoor space to have yard items. Lowe’s stores is actually big, having the typical sealed area of around 112,000 sq ft and about 32,000 square feet off yard place.

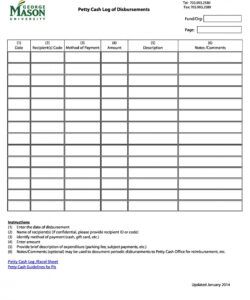

Inside 2019, Family Depot operated 18 physical delivery facilities about You.S. and something during the Canada. By comparison loans Brantley, Lowe’s works fifteen technical local distribution locations throughout the U.S. and you can seven in Canada. When Family Depot released their modernization system during the 2007, almost all of Lowe’s technical delivery locations were currently positioned, providing credence on impact one Lowe’s got liked a logistical advantage on their competitor for decades.

Trick Takeaways

- Once the planet’s very first and you will second-biggest do-it-yourself stores, Household Depot and you may Lowe’s share of a lot parallels. Continue reading