Though settlement costs will be lower which have an enthusiastic assumable mortgage, it will not be free. There might still be initial will set you back to invest in and import brand new home, and many of one’s websites one connect consumers and you will suppliers charge a fee for the services. And you will, as mentioned, you will have to can pay for to cover difference between the latest seller’s a great equilibrium as well as the sales rates.

Otherwise, you are able to utilize option investment, like an arduous money financing otherwise that loan out of a relative, due to the fact a temporary link loan. When you individual the house, you will be able to find a property collateral line of borrowing or house equity financing to pay off the fresh bridge loan.

step 3. Get ready for the borrowed funds Software

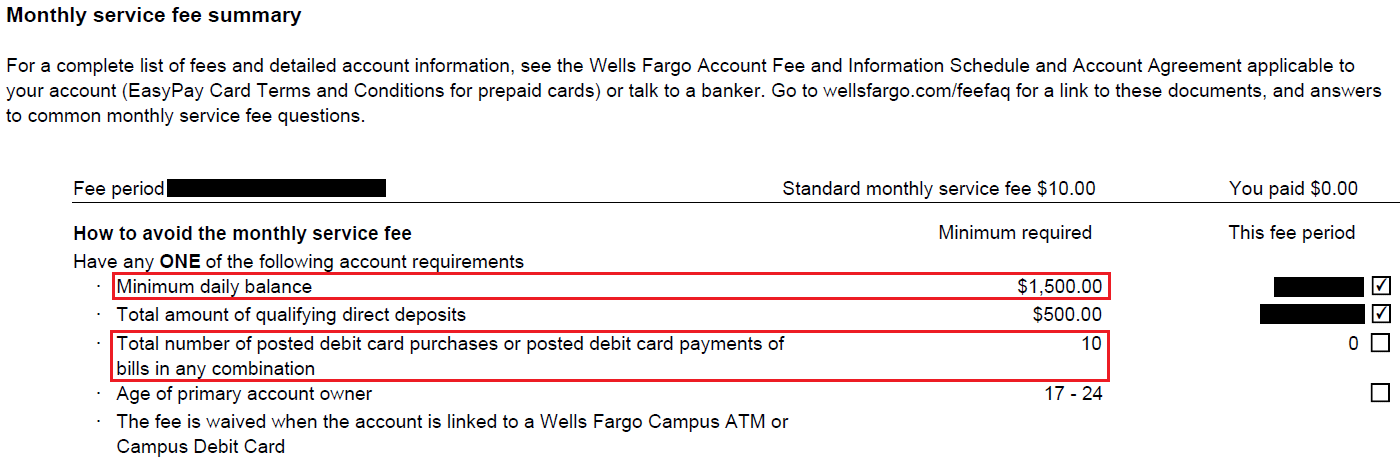

The application form and you can underwriting process was the same as making an application for a unique mortgage. You will have to share data to confirm your own identity, income and you will possessions, and you will commit to a credit score assessment. And you’ll have to wait for the loan’s servicer to review the job and you can qualification.

4. Close on the New house

Given that presumption becomes accepted, you’ll want to sign the common data files to help you transfer new home’s term and check in your purchase. But there is one additional action: The lender offers the merchant a release of liability, cleaning them of their duty on financial.

Faqs

- Exactly what Credit rating Do you need getting an enthusiastic Assumable Home loan?

You will need to qualify for the loan that you’re and in case, which means you might need a credit score with a minimum of five hundred having a keen FHA financing otherwise 620 to possess a good Va financing. Continue reading