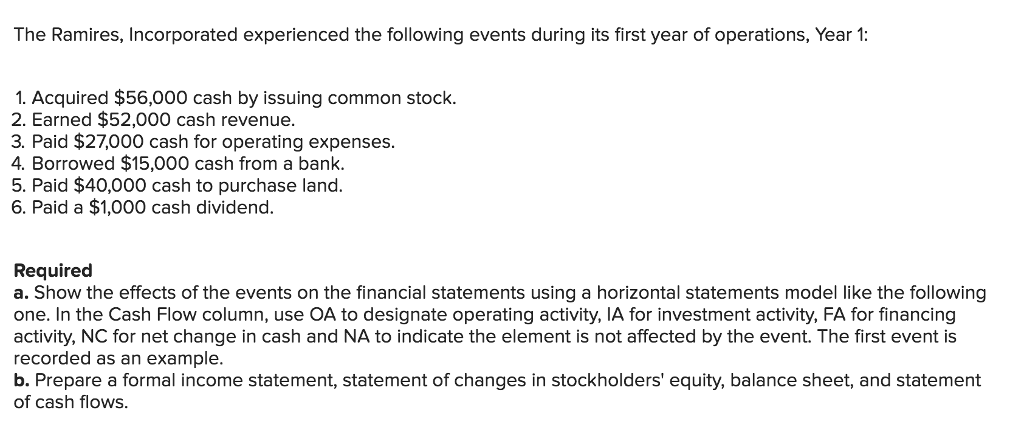

- Analysis

- Was We Qualified?

- Providing Distributions

Roth Private Senior years Accounts (IRAs) are a great choices when you’re seeking income tax-free withdrawals into the later years, would not want bringing expected minimum distributions (RMDs) otherwise end up being you will be in the same or a top taxation bracket from inside the retirement.

Possess

- Now offers tax-free development potential

- Certified distributions, which happen to be income tax-totally free and never found in gross income, shall be taken if your account has been established to get more than 5 years and you are clearly about decades 59 1/dos, otherwise as a result of their dying, impairment, or if perhaps utilising the qualified first-big date homebuyer different.

- Because the Roth benefits aren’t allowable, they may not be subject to tax and certainly will feel taken within at any time.

- Zero RMDs to your Roth IRA owner

Things to consider

- Their Altered Adjusted Gross income (MAGI) decides your own qualifications to lead.

- Benefits so you can a great Roth IRA commonly tax-deductible, so there is no tax deduction, no matter what income.

Roth conversion

An excellent Roth IRA sales happens when you take coupons out-of an excellent Conventional, September or Easy IRA, or licensed employer-sponsored old-age plan (QRP), such as for instance an effective 401(k), and circulate these to an effective Roth IRA. It is important to remember that you truly need to have an inducing event, like separation off provider, to-be eligible to make withdrawals out of your QRP. During sales, you will pay the suitable taxation due on in advance of-tax bucks converted; the fresh new ten% a lot more income tax does not incorporate toward count converted. The key benefits of income tax-free earnings inside the advancing years could possibly get validate the fresh conversion process. Make sure you talk to your tax coach to talk about your own particular problem when you transfer. Roth conversions are not permitted getting “undone” or recharacterized.

Someone at any many years with generated income, in addition to their low-working lover, in the event that filing a mutual tax return, qualify to sign up to a Roth IRA provided their Altered Adjusted Gross income (MAGI) matches next personal loans for bad credit in KS limitations:

Anyone less than many years fifty is contribute as much as $seven,000 to own 2024, according to Roth IRA MAGI limits. Eligible anybody years fifty or old, in this a certain taxation 12 months, can make a supplementary connect-right up contribution from $step one,000. The contribution to of your Antique and Roth IRAs can not be more new annual restrict for the decades otherwise 100% off earned earnings, any kind of was smaller.

Qualified withdrawals, which happen to be taxation-totally free and not included in revenues, might be drawn in case the membership might have been discover to get more than simply 5 years and you are clearly at least age 59?, otherwise right down to your own passing, impairment, otherwise using the earliest-time homebuyer exception to this rule.

You will find purchasing laws and regulations when you take nonqualified withdrawals. Any Roth IRAs is actually aggregated when using the shipping buying legislation.

Efforts already been earliest-The initial number delivered of any of your Roth IRAs, for those who have numerous levels, is yearly benefits. Just like the Roth benefits commonly allowable, they are certainly not susceptible to tax and can be taken in the any time.

Translated dollars are second-After you have tired all your valuable benefits, the following amounts distributed are from one sales you have complete. These types of transformation amounts are delivered taxation-totally free toward an initial-inside, first-aside foundation. Converted number pulled until the five-12 months holding several months or you was many years 59? otherwise earlier, any is actually first, possess an excellent 10% most income tax, unless an exception to this rule applies. Per transformation is subject to yet another four-season holding months.

Money is actually past-The final amount is distributed regarding income. Money pulled till the membership has been discover for over five years and you’re about many years 59?, and your dying, disability, or utilising the earliest-big date homebuyer exclusion, are part of revenues and subject to the newest 10% additional income tax to the early distributions, unless an exception can be applied.

Exceptions to your ten% more taxation-This new conditions was to own withdrawals immediately after getting years 59?, dying, disability, qualified medical expenditures, specific unemployed individuals’ medical insurance premium, qualified very first-big date homebuyer ($ten,000 lifestyle restriction), certified degree costs, Substantially Equal Occasional Money (SEPP), Roth sales, qualified reservist shipment, birth or use expenses (doing $5,000), certain certified disaster distributions laid out by Internal revenue service, Irs levy, certain qualified crisis withdrawals, laid out by the Irs, terminally ill (withdrawals can be paid contained in this three years), victims away from domestic discipline (doing $ten,000 detailed to have inflation) and you may ily crisis expenditures (acceptance just one shipping a year and must hold back until brand new shipment is actually repaid otherwise 36 months before taking a different sort of shipments having so it reasoning).