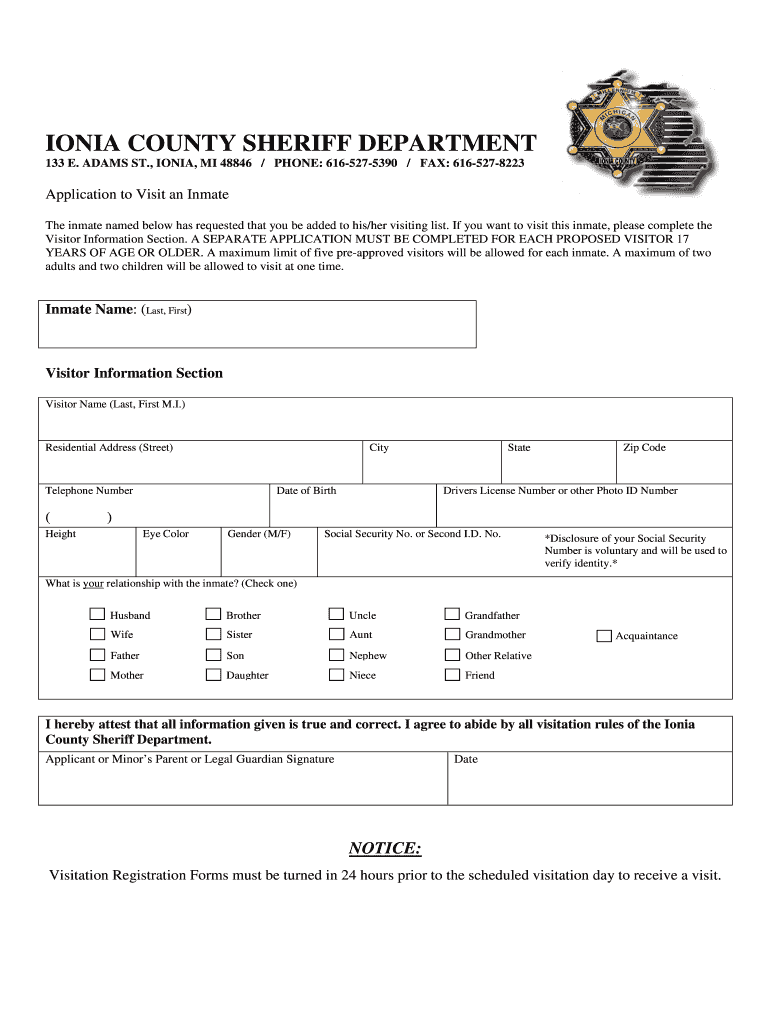

Possession are more well-known getting homebuyers taking away large funds

The fresh housing industry keeps shifted notably in earlier times four years, like concerning the home loan rates. In height of your own pandemic, rates strike number downs, and therefore benefitted homeowners at the time. However, pricing after that risen to a good 20-12 months high. Of , the average 30-seasons, fixed-price home loan (FRM) flower by the 422 basis issues, or cuatro.twenty two percentage affairs based on Freddie Mac study. At the same time, rates toward 5/step 1, adjustable-speed mortgage loans (ARMs) increased of the simply 292 basis affairs, otherwise dos.92 percentage circumstances from inside the same day.

Brand new concurrent surge during the home loan rates and you can U.S. casing cost enjoys triggered a fall in cost. Since the FRMs boost, specific homebuyers is actually examining alternatives for example Arms and buydown points to eliminate their monthly installments, particularly in the initial time of the financing. Per payment area rise in home loan rates mode more month-to-month will set you back to have homebuyers and causes large monthly payments.

Since the construction bubble bust for the 2007, FRMs are usual compared to Arms. The fresh new show off Arm buck frequency in the financial originations to an effective lower regarding dos% in the middle-2009. Since that time, the newest Sleeve express enjoys fluctuated anywhere between around 8% and you may 18% out of mortgage originations, with respect to the prevailing FRM rate (Figure 1).

The new Case share refused from inside the pandemic and strike good 10-12 months reasonable from cuatro% away from home loan originations inside . www.paydayloanalabama.com/hillsboro not, just like the FRM interest levels increased away from less than 3% so you can profile filed into the , Arms features gathered renewed attract. As of , the fresh new Case show taken into account 18.6% of your own dollar level of traditional unmarried-friends home loan originations, quadrupling from the reasonable.

Comparing the fresh Arm Give Home loan Prices:

The latest Sleeve show varies significantly predicated on location and you may loan amount. Possession are more common to have homebuyers taking out large money, especially jumbo money, than the individuals having faster funds. Certainly home loan originations surpassing $one million when you look at the , Fingers made up forty-five% of dollars frequency, a beneficial six commission-part raise regarding ong mortgages regarding $400,001 to $1 million variety, the fresh new Case display are approximately 17%, up by the cuatro percentage factors regarding . To own mortgages regarding the $200,001 so you’re able to $400,000 assortment, new Arm share was just ten% in .

Antique Sleeve Express because of the Loan Dimensions:

:max_bytes(150000):strip_icc()/206168221a-fefbe926de4c48c094658244b95a7d2b.jpg)

Although the Arm express is on the rise that have broadening mortgage rates, it stays below and other than pre-Higher Credit crunch profile. The most used Palms now will be 5/1 and 7/1 types, and this stop exposure.

By comparison, as much as 60% regarding Hands that were originated from 2007 were reasonable- if any-paperwork money, weighed against 40% of FRMs. Similarly, in 2005, 29% off Sleeve individuals had fico scores lower than 640, when you’re just thirteen% off FRM borrowers had equivalent fico scores. Currently, most antique financing, as well as both arms and FRMs, want full documents, is amortized, consequently they are designed to borrowers having credit scores a lot more than 640.

Because Hands has straight down 1st rates than simply FRMs, homebuyers feel more important month-to-month offers in the beginning, especially for big funds. Although not, interest movements is actually volatile and you may associated with criteria for example Secured Quickly Investment Rate, that can fluctuate. You should remember that there is no make certain that mortgage pricing tend to miss later, presenting an inherent attract exposure you to definitely Possession can result in enhanced monthly installments

At exactly the same time, FRM homeowners don’t have to love enhanced month-to-month home loan repayments. Whenever repaired cost was low, Fingers decreased inside the popularity Yet not, just like the repaired rates raise, Possession are getting more desirable so you’re able to homebuyers who wish to remain their initial mortgage will set you back only you’ll be able to. An arm was the ideal solution whether or not it aligns which have new homeowner’s otherwise homebuyer’s facts.

The pace on 30-12 months FRMs increased to help you 6.9% into the . But not, the speed for the 5/step 1 Hands flower merely to 5.7% for the (Source: Freddie Mac).