Best Mobile Trading Apps in India 2024

Join our 2 Cr+ happy customers. “Investor Bulletin: Stop, Stop Limit, and Trailing Stop Orders. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. The trendline should connect the higher lows to make an uptrend, and it should connect the lower highs for a downtrend. A technical analysis strategy relies on technical indicators to analyse charts, and the algorithms will react depending on what the indicators show, such as high or low volatility. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. It should be prepared on a consolidated basis when a group either manages its trading risk centrally or employs the same risk management techniques in each group member. The virtual portfolio in paper trading usually allows you to trade the same assets available for trading in a real brokerage account. View more search results. It acts as a “ceiling” where the supply of the assets increases. Press play for a tour of its features. Fill in the blank :Balance Sheet is of assets and liabilities. Also consider the investment options and account types supported to ensure the platform can support your needs for years to come. No matter what the market conditions are there is an options strategy that can take advantage of those conditions to profit, while taking on the risk of losing money as well. Quadcode logo is a registered trademark in the European Union, Russian Federation, Hong Kong and many other countries. A 50 day simple moving average SMA crossing over its 200 day SMA indicates upward short term trends and could signal the ideal opportunity to purchase. Once you have specific entry rules, scan more charts to see if your conditions are generated each day. Diversified portfolio trading. 1 Bank of International Settlements Triannual Survey, 20192 Calculated using figures from the IMF, 20193 Calculated using the initial contract value for 15 October 20084 Calculated using data from Coin Market Cap5 Calculated using Office of National Statistics average weekly earnings from Q3 20206 Calculated using a Forbes estimate of Jeff Bezos’s net worth, October 20207 By number of primary relationships with FX traders Investment Trends UK Leveraged Trading Report released June 2021. Price i The text to be placed inside the tool tip. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Algorithmic trading capabilities. If someone wants to acquire stock in a company, they must specifically say ‘intraday’ on the platform’s interface. Gain exposure to global stock indices including the US Tech 100, Germany 40 and Wall Street. Brokers typically offer a variety of deposit options, including electronic wallets, credit/debit cards, and bank transfers. 5% per transaction, meaning if you buy or sell stocks worth ₹1,00,000, you would incur a fee of ₹500. 49—the intraday high. Commissions for direct access trading, such as that offered by Interactive Brokers are calculated based on volume, and are usually 0. This was done as part of https://pocketoptionguides.guru/ research on trading in publicly traded companies with market capitalization levels around $3 billion and trading volumes below one million shares daily on average. Org is regularly audited and fact checked by following strict editorial guidelines and review methodology.

Return Filings

” Journal of Finance October 2021. In general, however, a trading account is distinguished from other investment accounts by the level of activity, purpose of that activity and the risk it involves. The major topic to study is technical analysis, which should include reading up on trading psychology and this is a must risk management. On the other hand, if the spot gold price dropped to 1802. Check out our full length, in depth forex broker reviews. Clients: Help and Support. Compared with opening a brokerage account for stock trading, opening an options trading account requires larger amounts of capital. Information presented by tastyfx should not be construed nor interpreted as financial advice. The Three Outside Down pattern starts with a bullish candle.

:max_bytes(150000):strip_icc()/dotdash_Final_Most_Commonly_Used_Forex_Chart_Patterns_Jun_2020-01-a6be7f7fd3124918a519946fead796b8.jpg)

An Example of Algorithmic Trading

Scalping is a type of trading in which traders buy and sell in very short periods of time with the aim of making a small profit. Scalping involves a high frequency of trading, which can result in high transaction costs such as commissions and bid ask spreads. But remember, even the most advanced tools won’t guarantee success—reliability and low costs remain essential for all traders. Just remember, the app that triggers the most headlines is not necessarily the best one for you. Past performance does not guarantee future results. However, a day trader with the legal minimum of $25,000 in their account can buy $100,000 4× leverage worth of stock during the day, as long as half of those positions are exited before the market close. When there’s not enough natural light in the space where I trade, I invest in natural light LED bulbs. Maximize your exposure to the underlying market with automated buy and sell orders. But what exactly constitutes insider trading, and what can companies do to minimise the risks. Hence, it is crucial to learn and adapt to market trends. Scalping has also been used by some in the volatile cryptocurrency market. The information contained on this website is not intended for a specific country audience and is not intended for distribution to countries where the distribution or use of this information would be contrary to local laws, requirements and regulations. Research analyst or his/her relative or Bajaj Financial Securities Limited’s associates may have financial interest in the subject company. On ET Prime Membership. An exponential moving average is. Our receipt of such compensation shall not be construed as an endorsement or recommendation by StockBrokers. By providing us with your personal https://pocketoptionguides.guru/zh/login/ information, you consent to its sharing with third party trading service providers in accordance with our Privacy Policy and Terms and Conditions. Industry Trends on 4000+ Stocks.

What’s New

Equity Delivery Brokerage. For example, potential support at the 50% Fibonacci level occurs if a trader identifies a previous uptrend and measures a retracement of 50%. Robinhood Gold is an account offering premium services available for a $5 monthly fee. So, if a positive piece of news hits the markets about a certain region, it will encourage investment and increase demand for that region’s currency. Sam Levine, CFA, CMT, formerly a lead writer for StockBrokers. Suppose a trader desires to sell shares of a company with a current bid of $20 and a current ask of $20. Watch our platform demos or join us live every Wednesday at 11 a. For example, salaries, advertising expenses, insurance premiums, etc. Thanks, @MightySoldiers for turning me on to @tradesviz.

Swing Trading

Com also has a number of helpful resources for traders, including a comprehensive trading academy with educational articles and webinars. Investors may also be turned off by the fact that Public requires users to manually opt out of tipping on each transaction, which the company calls “a more transparent, more aligned way to make money” than PFOF. Here’s one from Bill Lipschutz, one of the best traders of all time. We tested 17 online trading platforms for this guide. RHEC is supervised by the Lithuanian Financial Crime Investigation Service under the Ministry of the Interior of the Republic of Lithuania. I consent to receiving emails and/or text message reminders for this event. Required fields are marked. Leading indicators for intraday trading help to avoid risks. It’s not necessarily the end of the trading business. There are five parts of a standard stock options quote. Options trading strategies can become very complicated when advanced traders pair two or more calls or puts with different strike prices or expiration dates. It might not be as easy to use as Coinbase, but the fees are lower.

Developer information for Winer Union

Contact us: +44 20 7633 5430. Traders look for certain candlestick patterns like doji, engulfing or hammer/shooting stars to enter and exit trades within a day. As long as proper risk management techniques are followed along with the right position sizing you should be good to go. Use profiles to select personalised content. 5:00 PM to 9:00 PM/9:30 PM for Internationally linked Agricultural commodities. The securities are quoted as an example and not as a recommendation. To determine the best trading platforms for beginners, our team of experts started by evaluating 24 brokerage firms and investment platforms — from large, legacy brokerages to relatively new financial technology fintech companies. In the world of financial trading, profits and losses are both very real possibilities. Customers should consider the appropriateness of the information having regard to their personal circumstances before making any investment decisions. This is when you assume that you could have known something before it was possible to know it. If you’re looking to invest, rather than trade, we’ve got a guide to investing for beginners, and check out our best investment platforms. Pipe bottoms and tops develop due to the battle between buyers and sellers seeking control following an overbought or oversold move. It involves identifying and assessing potential risks and implementing strategies to mitigate them. Call it a “gut feeling. The retail online $0 commission does not apply to Over the Counter OTC securities transactions, foreign stock transactions, large block transactions requiring special handling, futures, or fixed income investments. Using the initial margin example above, the leverage ratio for the trade would equal 100:1 $100,000 / $1,000. Such people don’t use extremely short term charts at all. She specializes in coverage of personal financial products and services, wielding her editing skills to clarify complex some might say befuddling topics to help consumers make informed decisions about their money. A comprehensive visualization of Open Interest data for stocks. Energy and grains to shine as metals pause. AI trading refers broadly to the use of artificial intelligence, predictive analytics and machine learning to analyze historical market and stock data, get investment ideas, build portfolios and automatically buy and sell stocks. Copyright © 2007–2024 TrueLiving Media LLC Terms Privacy Risk. Trade during normal trading hours and over the weekend. Any form of trading requires risk management, and quant is no different. Talkoptions Add onTalkoptions Web. Here are the steps to get started. Known for being the gold standard in the brokerage industry, Fidelity has millions of customers and a reliability that’s undeniable.

How does swing trading differ from other strategies?

After the usual or regular trading hours end at 3. Stocks, bonds, ETFs, options, mutual funds, margin account and forex trading. Although it doesn’t really mean you’re not sophisticated – we’re sure you’ve got loads of style. 1 awards for Investor App and Web Trading Platform in 2024. Let’s consider more deeply the reasons why companies fail and let it be a warning for those who invest their money in trading. Pre built and automated portfolio options. These are the two most common types. The Relative Strength Index RSI is a popular indicator that is used in conjunction with candlestick patterns to verify overbought or oversold conditions. Predicting stock price movements is difficult, and if your guess about a particular security turns out to be wrong, options trading could expose you to severe and unlimited losses. Price action does not explicitly incorporate macroeconomic or non financial matters impacting a security. It is easy to download and install. Looking for a forex divergence. The capital is free for use on the same day. Investors can purchase options include equities, indexes, debt securities and foreign currencies, the focus here is mainly on equity and index options. I don’t want to be enticed to trade, and I don’t want to see a barrage of short term results in my face. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. These are currency pairs that contain two digital assets. Please Do NOT use keywords or links in the name field. At The Motley Fool Ascent, brokerages are rated on a scale of one to five stars. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. If you’re not using a tax advantaged account — such as a 401k, Roth or traditional IRA — taxes on gains and losses can get complicated. For scalping strategies, analytics may be classified in one of three ways. A question that many traders, especially beginners, ask is – is it possible to trade for a living. Learn more about leverage. Stock and ETF trades. Can I reopen my closed Tiger Brokers account. Trading for beginners can be exciting – and overwhelming. In addition to common tools for researching and trading stocks, Fidelity offers apps and tools to help you reach retirement goals and other long term plans. No worries for refund as the money remains in investor’s account. You can sign up to be a signal provider so that others can copy your trades.

Trading Terminal

To execute the strategy effectively, a trader must be able to spot trends in the market, anticipate upticks and downswings, and be able to understand the psychology behind a bull and bear market. It’s essential to choose a brokerage that employs robust security measures to protect users’ personal and financial information. Robo advisor: Ally Invest Robo Portfolios IRA: Ally Invest Traditional, Roth and Rollover IRAs Brokerage and trading: Ally Invest Self Directed Trading. For Filipinos interested in stocks, bonds, mutual funds, ETFs, forex, crypto, banking, business, insurance, and any other topic related to investing money, making money, or growing money in the Philippines. The doji is within the real body of the prior session. There are several advantages to trading options rather than underlying assets, such as downside protection and leveraged returns, but there are also disadvantages, like the requirement for upfront premium payment. Consequently, Syntax Finance cannot be held responsible for any financial losses or other consequences resulting from your trading or investment activities. Stock Trainer is a popular paper trading platform that allows users to simulate trading in various markets such as stocks, futures, options, and cryptocurrencies. Understanding the principle of investing is vital before delving into the types of equity trading. Trading during these hours is considered beneficial. When people talk about investing they generally mean buying assets to hold long term. They are not intended for distribution or use in any location where such distribution or use would contravene local law or regulation.

Recent Platform Updates

As the volatility increases the Bollinger band expands and they contract as volatility decreases. Number of cryptocurrencies offered: 2. 80% of retail investor accounts lose money when trading CFDs with this provider. If that isn’t enough for you, here are more reasons for using the Vyapar trading account format. I know people who have won free crypto. Meanwhile, you can prepare for your retirement with long term position trading. While the top performers in the 99th percentile might earn six or seven figure annual incomes, most day traders fail to match even minimum wage earnings when accounting for time invested and capital risked. Thanks to the trading account facility, investing in stocks, commodities, and currencies is no longer limited to the experts or the wealthy. Since the trading strategy is the base of all your trading activity, its quality and robustness, which we will cover later in this guide, dictate how much money you will make. Definition: Vega measures an option’s price sensitivity to changes in the underlying asset’s volatility. One can get answers to all the questions in these books. Reselling things for a higher price is not a new idea. A balance sheet examination can reveal a wealth of information about a business’s performance. Sketchy economic times require backup plans. Margin investing involves the risk of greater investment losses. Create profiles for personalised advertising. When you transfer your investment portfolio to Public. The Follow Feed feature enables you to see the trades taken by a group of experienced traders, helping you to keep ideas flowing. So, we’ve created a table below with five key trading terms every beginner should know. There were no instances of non compliance by Bajaj Financial Securities Limited on any matter related to the capital markets, resulting in significant and material disciplinary action during the last three years. Research analyst or his/her relative has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: No. All investments involve risk, including loss of principal. The application is highly intuitive and easy to navigate for traders with experience. You acknowledge and agree that in the course of providing “order execution only” OEO trading services to you, Neither MFCI nor their representatives are responsible for making a determination that the products and account types offered are appropriate for you. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. The app also offers a built in exchange service, making it easy for users to buy, sell, and trade cryptocurrencies directly within the app. Options are based on the value of an underlying stock, index future, or commodity.

Popular Sections

Please check back in some time. A good rule is limiting any trade to less than 20% of your total drawdown. If I had these available when I taught stock investing at a business school, I would have used them in my class. The market is the best teacher. There are very many types of trading: high frequency trading, scalping, day trading, swing trading, middle term trading and long term investing. What is a stop out or margin closeout. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. © 1998–2024 Noble Desktop Privacy and Terms. The price at which the contract is entered is the strike price or the exercise price. It can be too easy to be sucked into the hypnotic world of flashing numbers and moving charts. Please check out our article about Moneybhai Review for more detailed insights. On top of those, varieties of other technical indicators exist in the stock market with smoothing procedures and a blend of different ranges to predict and analyse the stock.

Enjoy High Liquidity Markets

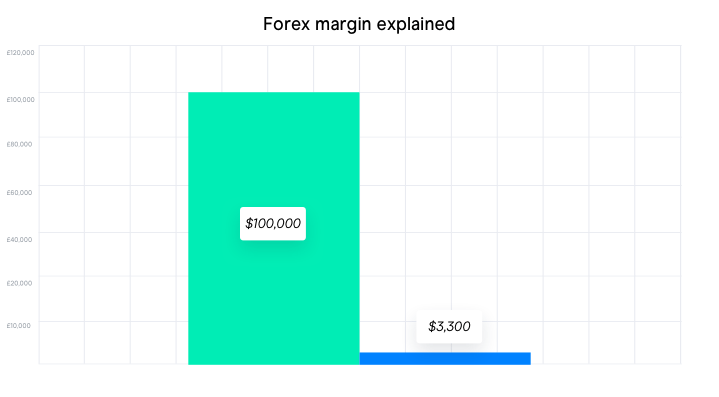

Bullish and bearish crossover patterns signal price points where you should enter and exit stocks. Testing out more than one app based investment offering can also give you more insight to properly compare and contrast features that match your preferences. Some forex traders ensure they’ve closed out of their positions before the end of their own trading day to avoid the risk of losses due to the net financing rate. Once you log in to your trading account, you get access to the Indian stock market from any part of the world and at any time. Yes, the broker you choose to use will greatly impact the kind of markets you have access to, the sort of trading tools you can use, the cost of trading, the amount of fees you pay, and the quality of the research and educational resources you can leverage when making trading decisions. Margin is the amount of money your broker requires to be put aside when you wish to open a position. Descending triangles can be identified from a horizontal line of support and a downward sloping line of resistance. The prospect of being fully financially independent just by trading a few hours every week is nothing short of a dream. So, there’s substantial risk of profits or losses outweighing your margin amount. Beyond her professional pursuits, Lorea is an avid traveler, surfer, and scuba diver, embodying a true spirit of adventure. Everything else is irrelevant. The data collection process spanned from Feb. This information is strictly confidential and is being furnished to you solely for your information. Indeed, with the evidence showing that most day traders lose money over time, it’s an extremely risky career choice. Pro tip: Professionals are more likely to answer questions when background and context is given. A type of day trading where traders make short duration trades to leverage price swings. When the 2 lines cross up it can indicate a good time to buy, if they cross down it may be a good time to sell. Of any of the Rules, Regulations, Bye laws of the Stock Exchange, Mumbai, SEBI Act or any other laws in force from time to time. Staking is another option for those who have significant crypto assets and want to hold them but at the same time accrue more value. Software wallets are digital wallets that are accessible through a computer or mobile device, and are the most common type of wallet.

Unlocked: Crypto Handbook!

Use our trading diary to document thoughts, observations, and lessons from each trade. Develop and improve services. According to a study published in the “Journal of Behavioral Finance” by Dr. Take a look at the key types, features and uses of options. On BlackBull Market’s secure website. The following traders pay the spreads. Those who have demonstrated a low risk tolerance are tempted to take more risk by copy trading. These quotes encapsulate the vital role that discipline plays in trading. Electronic trading poses a unique risk to investors. Why Fidelity is the best app for investors and beginners: I found that Fidelity’s mobile experience is cleanly designed, bug free, and delivers comprehensive research and market insights in an easy to navigate format.

NSE Group Companies

70% of retail client accounts lose money when trading CFDs, with this investment provider. Take for instance this example of a golden cross in TSLA. Do not make payments through e mail links, WhatsApp or SMS. 8 million shares daily on average. Many of the top European brokers offer high quality mobile trading apps. Currently, he leads a team of quants in a prop trading firm engaged in alpha research and strategy development. Create your free account or sign in to continue your search. There is no difference between the equity market and the stock market. Use it to quickly gauge your algo trading strategy performance. Therefore, tracking the market consistently becomes a priority for a day trader to make a profit. What’s more, you can access the settings you enable on thinkorswim’s powerful desktop platform in app, meaning your chart drawings and market scans are always with you. Functionality is limited, and you won’t find any advanced crypto trading bells and whistles, but for many using this product, such offerings aren’t necessary. Look at the image below. The best forex hedging strategies. The neckline breaks, the retails enter longs and the price totally reverses and targets the stoplosses of these retail longers. As an example, these rules could be based on the time and price at which orders and quotes are entered into the system. Suraj Kumar 17 Nov 2022. Reach out to us, we’d love to start a dialogue with you. Paper Trading may provide a false sense of security. A demat account works like a bank account where you hold money for trading. Understand audiences through statistics or combinations of data from different sources. Smaller tick sizes can lead to more precise pricing and tighter bid ask spreads, reducing your trading costs. A to Z on forex trading strategy. We also do pro account trading in Equity and Derivatives Segment. If you want to know more about tick charts and how I trade them on the Futures market, check out my Youtube playlist. For instance, during an uptrend an asset’s price may fall back slightly before rising once more. At The Robust Trader, we use Tradestation, Multicharts, and Amibroker.