Share this short article

Regarding to get a home throughout the Netherlands, your work offer performs a life threatening character during the choosing your financial choice. And possess a permanent offer provides stability and cover, you will need to observe that you never always need it to safer a home loan. The prerequisites are far more versatile, permitting solution a position arrangements. Throughout this post, we shall speak about exactly how various job agreements may affect their qualification to possess a home loan.

Is actually a long-term price required to score a home loan?

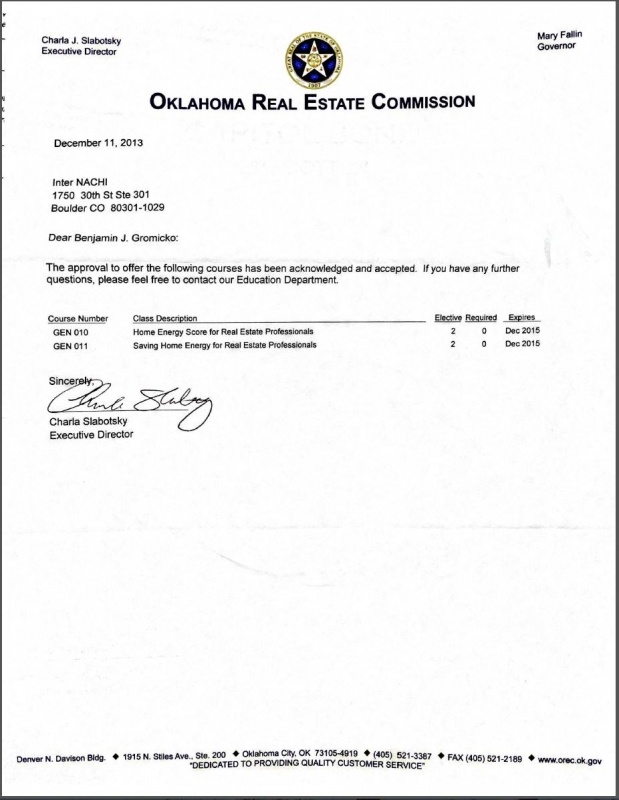

The fresh new short response is no. In comparison to traditional viewpoints, you don’t usually you would like a long-term contract so you’re able to be eligible for a great financial on Netherlands. Loan providers are particularly so much more accommodating and know choice work arrangements. Which have a beneficial step three-seasons functions records or a page of intent from your boss should be adequate to have shown your income balances and you can safer a good home loan.

Do you really rating a home loan and still in the demo months?

Even though you can talk about mortgage choice versus a permanent deal, it’s important to remember that you may want to face limits via your demo months(s). Normally, lenders are wary of approving mortgages for those who are within their demonstration day(s). This new suspicion close the soundness of one’s a career during this time period could possibly get raise concerns for loan providers.

Long lasting employment agreements

A long-term a career deal, known as a long bargain (vast offer), brings balances and security so you can lenders. With this specific particular offer, you have access to an array of financial solutions, aggressive rates, and expanded installment terms. Additionally, lenders glance at long lasting deals absolutely, because they mean what you can do to meet up home loan loans, boosting your to invest in power and flexibility in choosing a home.

Short term work price

That have a short-term employment bargain (tijdelijk bargain) does not have any to obstruct your own financial possibilities. While the lenders generally choose stable money present, you can however safe home financing having a fixed-name bargain. As stated prior to on the blog post, showing a beneficial step three-year work history or taking a letter regarding intention can program your revenue stability. Lenders together with think about the contract’s duration and you may candidates to possess renewal, and if you will find a strong probability of extension, they could be happy to provide advantageous financial conditions.

Freelancers and you will thinking-employed someone

Freelancers and you may notice-employed somebody find book demands whenever looking to a mortgage regarding the Netherlands. Loan providers wanted most evidence of earnings stability and value due to this new adjustable character of the earnings. To help you qualify, getting multiple years’ value of taxation statements, monetary comments, and you will a stronger business plan often is requisite. Lenders economic and you may providers viability, business feel, and you can available supplies.

Other factors to adopt

Although the self-reliance into the occupations offer standards opens gates for much more men and women to go into the housing market, there are many more things one lenders to take into consideration when assessing your payday loans El Moro own home loan qualifications. These types of items are your credit score, debt-to-earnings proportion, savings, as well as the size of your own deposit. Indicating financial balances and you can responsible monetary administration often next enhance your probability of securing a mortgage. Concurrently, to obtain a loan you ought to have a beneficial BSN matter.

Consult with financial positives

Looking to recommendations of financial advisors who focus on helping those with choice employment agreements would be very of use. These positives offer worthwhile knowledge, help you see the particular requirements various loan providers, and you will direct you for the the best home loan alternatives considering your issues.

Key takeaways

On Netherlands, securing a mortgage is no longer exclusively dependent on with good permanent employment offer. To your regarding a lot more flexible standards, people who have a good 3-12 months work history or a page out-of intention can also qualify having mortgage loans. However, it’s important to be aware of the constraints throughout demo episodes. To browse the procedure effortlessly, seeking suggestions from mortgage pros is highly recommended.

Author’s mention: This short article is made in collaboration with Expat Mortgage Program, a family that provides mortgage loans for internationals thinking of moving holland. It do just fine into the a person-centric environment, taking a smooth sense and come up with clients be home. Which have complete freedom and you may across the country coverage, they try and submit nothing but an informed due to their website subscribers.