While the our company is seeing, the aforementioned factors always apply far more so you can national banks. Local banking institutions is a tad bit more versatile and will even promote mortgage apps particular to barndominium construction if you have already been adequate from it in your area.

Fundamentally, a lender of every size is finding a loan they can feel confident in and then make getting a project that suits inside antique recommendations and will have a marketable financial one to supports this new home’s worthy of.

Third-Cluster Loan providers

This is much like a financial and $1500 loan with poor credit in Locust Fork you can practically an identical because it’s in more antique varieties of custom-built home framework. However, there are some famous variations.

Normally, a beneficial 3p lender’s fund follow the exact same design due to the fact men and women away from a timeless bank you are getting a houses financing that is converted to a mortgage at the termination of the project.

However, as they focus on pole barn strengthening investment, there can be fewer hoops because the bank knows exactly how barndos is actually developed in addition they know needed comps which can be custom this new design on slab otherwise crawlspace-they are certainly not limiting comparables to other freshly developed barndos and that is generally more difficult to find, instance with respect to the business in which a person is building.

Same as researching good bank’s framework funds, it is vital to spend your time taking a look at the fresh new conditions and terms out-of a third-party lender’s financing.

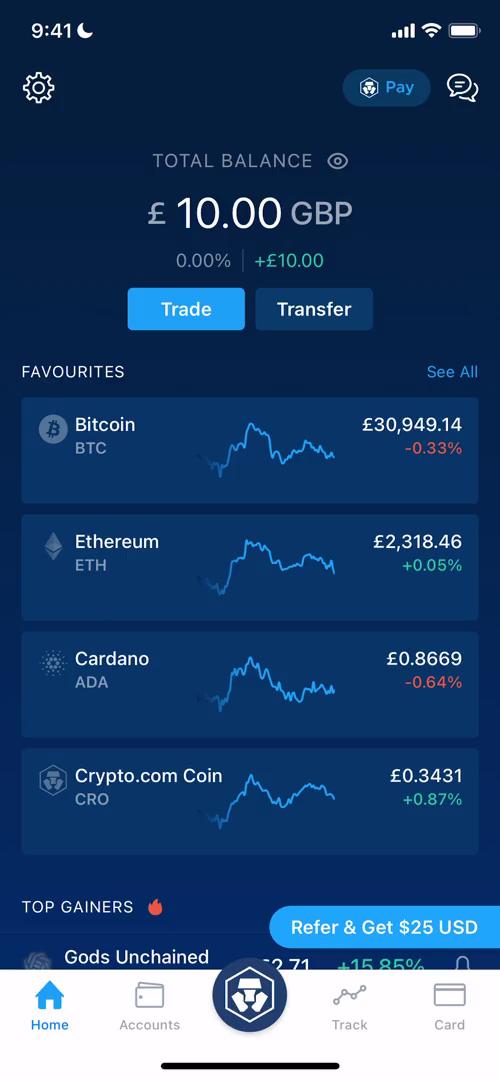

Prospective Affairs: One of the greatest downsides to that particular investment route should be interest levels (we all know, they truly are anything most of the upcoming homeowners is contending which have).

While a great 3p lender might possibly be friendly to publish body type domestic construction plans, their rates is almost certainly not just like the amicable to the purse. Continue reading